|

Ocean rates have been in free-fall for a number of months now, with Asia Pacific to the U.S. West Coast dropping 51% and 55% to the East Coast since peaking in late 2021. However, events in the Red Sea and Panama are changing all that.

The price of sending goods around the world is spiking after six weeks of disruptions in the Red Sea, where Iran-backed Houthi militants are attacking commercial shipping vessels. The disruptions pose a threat to the global economy nearly four years after the pandemic woke the world up to the existence—and fragility—of supply chains.

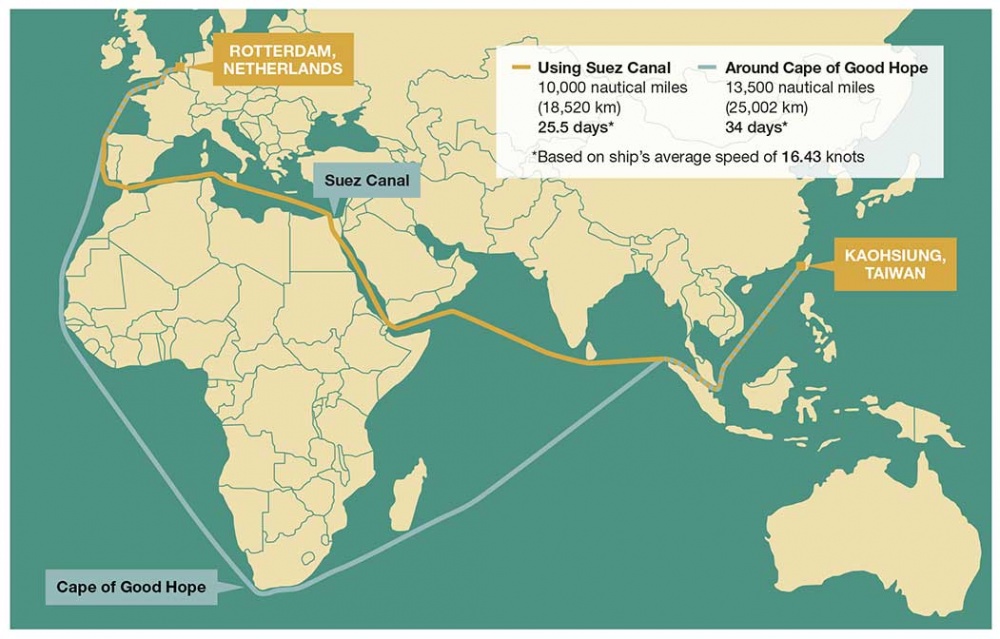

Alternative route for shipping while Suez Canal blocked

About 30% of global container ship volume moves through the Suez Canal, which links the Red Sea with the Mediterranean Sea, says Jonathan Colehower, managing director of the global supply chain practice at UST.

Spot rates for shipping goods from Asia to Northern Europe are up 173% compared to before shippers started rerouting shipments, and rates to North America’s East Coast are up 52%, according to a report from Freightos, a booking and payments platform for international freight.

Global ocean shipping disruptions will likely add to air and land freight movements in 2024. The two primary routes from Asia to the U.S. East Coast have been snarled by conflict in the Red Sea and low water in the Panama Canal, which is essentially a perfect storm restricting access to the U.S. East Coast. The West coast ports and intermodal network will likely continue to experience elevated demand as a result.

The Red Sea disruptions are causing diversions of marine traffic around the Cape of Good Hope, adding about 10 days and 3,500 miles to supply chains. Clearly, this will affect price and service, particularly for e-commerce freight and will likely result in diversions to air and land where possible.

As reported in the WSJ and Logistics Management, “billions of dollars’ worth of goods have shifted away from the channels leading to the Suez Canal as carriers divert ships to avoid Houthi rebel attacks.” As a result of such supply chain disruptions, average worldwide costs to ship 40-foot-long containers have nearly doubled since late November, according to Drewry Shipping Consultants.

The increases have also accelerated in the past two weeks on routes that traditionally use the Suez. The higher costs are hitting even importers that negotiate longer-term contract rates, because operators are imposing surcharges amounting to hundreds of dollars per box on some traffic.

So, while 2024 looks like it may be a fairly close copy of 2023 in terms of supply chain execution and cost in e-commerce moves, forecasting is even more precarious, given the instability and conflict that has no upside—only more disruption. This inevitably leads to service and cost impacts.

https://www.logisticsmgmt.com/article/e_commerce_logistics_an_endless_array_of_challenges

|