|

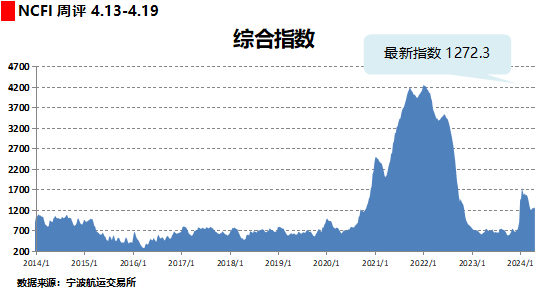

This week, Ningbo Export Container Freight Index (NCFI) of the Maritime Silk Road Index (referred to as "Maritime Silk Road Index") issued by Ningbo Shipping Exchange closed at 1272.3 points, up 1.2% compared with that of last week. 11 out of 21 routes saw an increase in the index, 9 routes saw a decrease in the index, and 1 route was basically flat. The freight index was basically flat. Among the major ports along the "Maritime Silk Road", 10 ports' freight indices increased and 6 ports' freight indices decreased.

The indices of key routes in this reporting period are as follows.

European routes: transport demand is generally stable, supply and demand relations remain good, this week's market tariffs maintain stable fluctuations. The freight index of European routes was 1286.0 points, down 0.1% compared with last week; the freight index of Eastern routes was 1470.0 points, down 0.9% compared with last week; the freight index of Western routes was 1748.1 points, basically unchanged compared with last week.

North America route: pre-holiday market demand for transport has risen, this week the market rate of decline significantly narrowed. U.S. East Route Freight Index was 1211.4 points, down 0.1% from last week; U.S. West Route Freight Index was 1654.0 points, down 0.5% from last week.

Middle East routes: after Iftar destination market shipping demand has declined, spot market booking prices fell slightly. Middle East route index is 1601.3 points, down 7.2% from last week.

This week, the fluctuation of the South America East route is bigger.

Destination transport demand continued to improve, the route space to continue the tight situation, the market tariffs continue to rise sharply. South America East Route Freight Index was 2575.7 points, up 15.0% from last week.

The main ports along the Maritime Silk Road freight index changes are as follows.

ASEAN region: this week, a total of 5 ports freight index rose, 1 port freight index fell. Among them, Ningbo (China) - Singapore (Singapore) freight index rose 2.9%; Ningbo (China) - Klang (Malaysia) freight index rose 1.1%; Ningbo (China) - Ho Chi Minh (Vietnam) freight index rose 7.7%; Ningbo (China) - Bangkok (Thailand) freight index rose 7.7%; Ningbo (China) - Bangkok (Thailand) freight index rose 7.7%. -Bangkok (Thailand) Freight Index rose 14.3%; Ningbo (China) - Linchaban (Thailand) Freight Index rose 13.1%; Ningbo (China) -Manila (Philippines) Freight Index fell 2.2%.

Europe: Ningbo (China) - Constanza (Romania) freight index rose 1.1%.

South Asia: total of 2 ports freight index rose this week. Among them, Ningbo (China) - Navasiva (India) freight index rose 8.3%; Ningbo (China) - Pipavavo (India) freight index rose 7.8%.

West Asia region: this week, a total of 2 ports tariff index rose, 3 ports tariff index fell. Among them, Ningbo (China)-Istanbul (Turkey) freight index fell 2.0%; Ningbo (China)-Aqaba (Jordan) freight index rose 1.5%; Ningbo (China)-Jeddah (Saudi Arabia) freight index rose 1.0%; Ningbo (China)-Dammam (India) freight index rose 7.8%. ) - Dammam (Saudi Arabia) Freight Index fell 7.6%; Ningbo (China) - Dubai (UAE) Freight Index fell 6.8%.

North Africa: Ningbo (China)-Sokona (Egypt) Freight Index fell 0.4% YoY.

Northeast Asia: Ningbo (China)-Novosibirsk (Russia) Freight Index fell 2.2% year-on-year.

https://www.cnss.com.cn/html/hygc/20240422/352951.html

|