Analysis by Lloyd's List shows that transporting sanctioned Russian crude could bring shipowners an additional $4.7 million to $9.7 million per voyage, which is lucrative compared to traditional trades. This reflects the fact that average freight rates on these routes are one-and-a-half times higher than in non-sanctions markets in the first four months of 2024.

These profits were calculated using data from price reporting agency Argus Media, which assesses freight rates levels for Aframax and Suezmax tankers on the main routes from Russia to the west coast of India and northern China.

For example, the freight rate for an Aframax tanker loading 80,000 tonnes of Urals crude from the Black Sea port of Novorossiysk to northern China for the week ending 26 April was $115 per tonne, totalling $16.1 million, according to Argus Media. Of this, the sanction premium was assessed at $9.7 million, which is the additional amount that the cargo buyer or seller would have paid for the tanker compared to similar routes currently available on the spot market. This is the highest freight premium calculated using Argus Media data.

These assessments suggest that transporting Russian oil can be highly profitable and create difficulties for the West in imposing sanctions through oil price caps. Under the oil price cap imposed by the G7 16 months ago, Western service providers (including shipowners, charterers, insurers and banks) are not allowed to ship Russian oil to third countries unless the price of the cargo is below a certain price. The price cap is $60 per barrel for crude oil, $45 per barrel for fuel oil and $100 per barrel for refined products.

According to Argus Media, the price of Russian oil transported from Murmansk and Black and Baltic Sea ports has exceeded $60 per barrel in 10 of the past 11 months. The average price of Urals crude in April was assessed at $72.72 per barrel; ESPO crude transported from Russia's eastern coast was $83.14 per barrel. Critics of the oil price cap say false documentation and deliberately high freight and ancillary costs have been used to circumvent the cap, which was described as "flawed" and "unenforceable" in a submission to a UK parliamentary inquiry this week.

In 2024, Russian crude oil shipments will average about 5 million barrels per day, with India, China and Turkey the main destinations. Lloyd's Register Maritime Database and Vortexa data show that more than half of the volume in April was transported by parallel or "shadow fleet "* tankers operating outside Western jurisdictions. Of the nearly 300 tankers that called at Russian oil-exporting ports last month, some 174 belonged to the shadow fleet. This category of older, anonymously owned tankers is most likely to benefit from ultra-high profits, as most operate outside Western jurisdictions. When premiums are high enough, owners can earn back the cost of purchasing a vessel after four to five voyages. In the 24 months to mid-2023, more than 300 tankers worldwide were sold to the shadow fleet for between $25 million and $33 million (depending on vessel size, construction and age).

Argus Media's data shows that current sanction premiums for Suezmax tankers range from $5.5 million to $9 million per voyage, depending on route and destination.

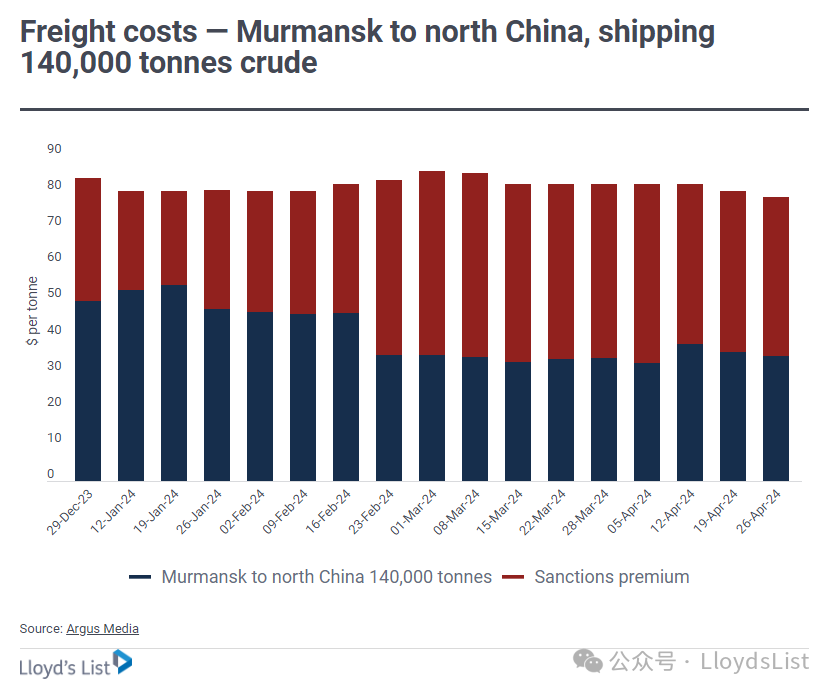

For the week ending 26 April, freight rates for a Suezmax tanker transporting 140,000 tonnes of oil from the Murmansk Arctic port to China or India ranged between $78.57 and $66 per tonne. This equates to a freight rate of between $10.9 million and $9.5 million for the voyage, of which the sanctions premium was assessed at $6.1 million to $5.5 million. The freight rate for the Murmansk to China voyage was assessed by the Baltic Exchange at $78.57 per tonne (of which $43.89 was the sanctions premium). This compares with $18.65 per tonne for the shorter West Africa-UK route in traditional spot market transactions.

https://www.cnss.com.cn/html/hygc/20240506/353082.html

|