The tanker fleet may face a major challenge if reductions in global fossil fuel consumption are in line with global temperature control targets for 2050, according to analysis by the Energy Institute and Kühne Climate Center at University College London (UCL).

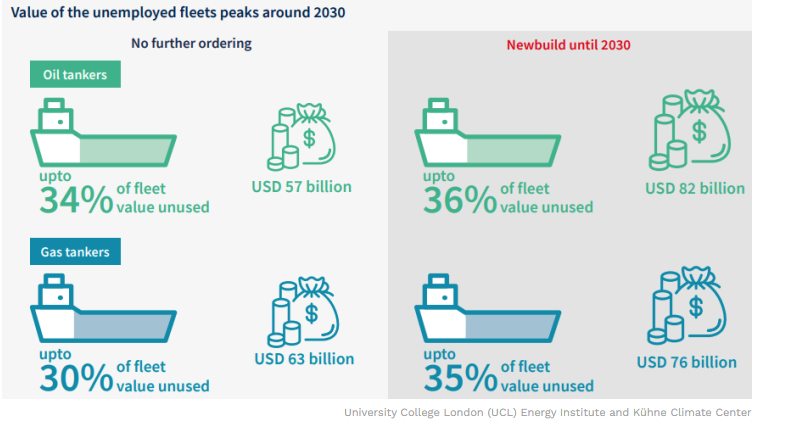

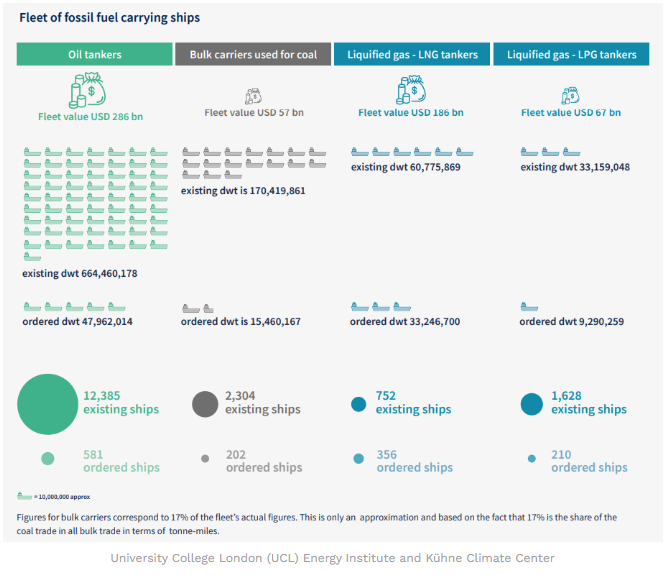

The findings show that a significant portion of the world's oil and liquefied gas transport fleet, with a total value of up to $539bn, is at risk of idling. Excluding depreciation and financing costs, potential losses could reach $214 billion, or 32 per cent of the fleet's expected profits. It is expected that the total value of the idle fleet could climb to a peak of $108 billion by around 2030, which would represent 30 per cent of its total value.

The ability of the fleet to mitigate these risks by transporting alternative cargoes remains severely constrained. Some 18,000 ships currently transport fossil fuels, accounting for more than a third of global shipping activity.

Marie Fricaudet, head of the research project, explains, ‘Our study illustrates the situation that ships transporting fossil fuels would face if we as a society chose to follow the universally recognised goals of the Paris Agreement and try to avoid the catastrophic consequences of climate change. For oil and liquefied gas carriers, the results of the study can be alarming: some 37 per cent of their expected profits will be lost if shipbuilding activity continues until 2030."

The transition to a low-carbon society presents both challenges and opportunities. Investments in fossil fuel-dependent businesses are increasingly at risk, and avenues for sustainable alternatives are emerging. The International Energy Agency predicts that demand for coal, oil and gas will decline significantly by 2050, necessitating a shift in investment priorities.

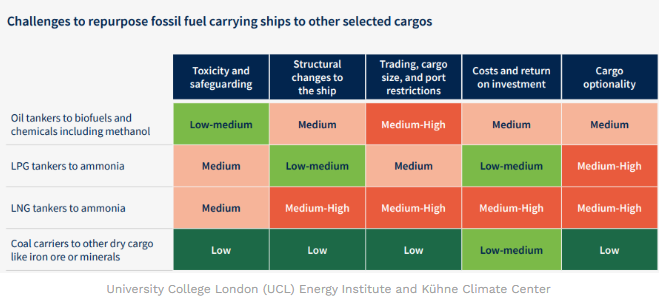

Repurposing ships for the transport of alternative cargoes presents challenges, particularly for specialised vessels such as LNG carriers. From a technical point of view, LPG carriers are relatively more likely to transport ammonia; some crude oil tankers may find biofuels or chemicals to transport. However, there are still many uncertainties regarding the market and transport demand for new energy products, as well as the economic viability of converting ships to transport fossil fuels.

In contrast, bulk carriers transporting coal have more flexibility in converting to other dry bulk cargoes. Overall, investments aligned with the climate transition are encouraged, including the expansion of dry bulk transport capacity and the development of low-carbon fuels.

Stefanie Sohm of the Kuna Climate Centre said that our projections, while only indicative, should prompt investors and shipping operators to assess their climate risks and reorient their investments. The transport sector must play a role in the transition to a low-carbon society by redirecting funds to areas that contribute to this transition.

Overall, this work demonstrates the urgent need for stakeholders to assess climate-related risks and reorient investments. While there is uncertainty about future demand and the trajectory of the energy transition, proactive measures are essential for sustainable development.

https://www.cnss.com.cn/html/sdbd/20240610/353701.html

|