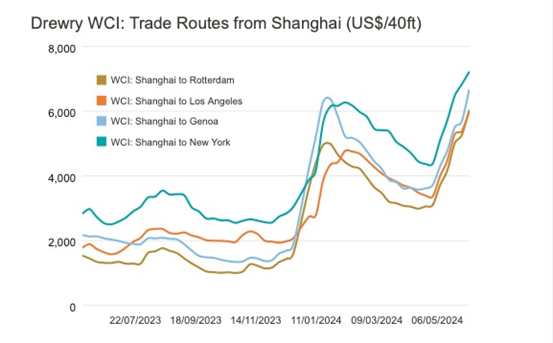

It is indisputable that spot rates on the major East-West routes have risen faster than any analyst, shipping line or forwarder could have predicted over the past five weeks. With the Drewry World Container Index (WCI) now attracting global attention, and the industry looking for the first signs of a top, the obvious question is: how high will the peak be?

Since May, the WCI has risen ‘+1 per cent, +16 per cent, +11 per cent, +16 per cent, +4 per cent and +12 per cent’ to finally settle at $4,716/FEU, up about $2,000/FEU. 181 per cent compared to the same period last year; and $1,420/ FEU average of 232%.

Among the routes from China, there were increases across the board. Shanghai-Genoa rose to $6,664/FEU, Shanghai-Rotterdam to $6,032/FEU, Shanghai-Los Angeles to $5,975/FEU, and Shanghai-New York to $7,214/FEU.

Drewry expects rates outside of China to continue to rise next week due to the early peak season.

Indeed, the short-term temptation to forecast above the $5,000/FEU mark is real, with the market talking about much higher freight rates than the WCI suggests.

European forwarders are warning that spot rates from Asia will break the five-figure mark next month. ‘As expected, spot rates are breaking the $10,000/FEU mark from 1 July, and several liner companies’ online pricing platforms are already reflecting this."

Whether spot rates will continue to soar will likely depend on how long demand lasts.

Judah Levine, principal analyst at Freightos, said, ‘If the increase in demand is due to an early peak season, we can expect demand-side pressures to subside within a few months, and sooner than usual.’

He added, ‘Just as freight rates climbed in the run-up to Chinese New Year due to a combination of demand and capacity constraints in the months leading up to the bypass, and fell back after demand eased, so too should freight rates and congestion fall when peak season demand slows down, although until the Red Sea crisis is resolved we can expect rates to be no lower than they were in April.’

Meanwhile, data from Container xChange, an online container logistics platform, shows that the increasing scarcity of containers in Asia's export hubs, lack of vessel capacity and increased demand for ad hoc shipments are the main factors behind the spike in container prices.

Container prices soared in May, the peak season for China's container market. The average price of a 40ft HCL at China's major ports was US$2,240 in April and rose to US$3,250 in May, an overall increase of 45 per cent.2021 During the September epidemic, the price index had soared to a high of US$7,178.2022 The price of a 40ft HCL at China's major ports rose to US$3,250 in May, a 45 per cent increase.

Christian Roeloffs, founder and CEO of Container xChange, said the reasons for the rise in container prices were the same as those that drove the recent spike in spot rates, adding that container prices could fall just as quickly.

"When we look closely at the market, it is clear that the current spike in container prices is not sustainable in the long term as it is not supported by strong underlying demand. Concerns about the labour market and high interest rates mean that consumers are likely to cut back on their spending, which could lead to a fall in demand for commodities, which could reduce shipments in the short term - unless the demand recovery becomes stronger and supply capacity absorption intensifies."

He added, ‘We expect container prices to stabilise, if not decline, in the medium term as the initial re-stocking frenzy subsides and actual demand from consumers and businesses remains flat; the market is showing signs of volatility driven by short-term factors rather than a sustained increase in demand.’

Frankly, there is also an exponential increase in reports about how bad the shipping and supply chain situation is at the moment ...... In ShippingWorld.com's view, much of the perception is partly driven by shippers, analysts and the media. Clearly, all this negativity, finger-pointing and whining is certainly ‘not’ the answer.

In short, the market should not forget that, in the face of the great uncertainty of the ‘age of contention’ that we are entering, it is the leading liner companies, represented by MSC, Maersk and Duffy Group, that are investing in expanding their fleets and terminals to maintain ‘redundancy’ in capacity supply, or vertically expanding their sustainable capacity. The continued investment by the leading liner shipping companies, represented by MSC, Maersk and Duffy Group, in expanding their fleets and terminals, maintaining ‘redundancy’ in capacity supply, or vertically expanding sustainable ‘diversified’ shipping and logistics solutions, as well as investing in the energy transition, are helping to provide differentiated or personalised choices to the global community and to their customers, and are thus helping to continue to improve the resilience and reliability of their supply chains, as well as to advance the process of decarbonisation.

https://www.cnss.com.cn/html/hygc/20240611/353717.html

|