Recently, the global container shipping market has regained the hot situation at the peak of the epidemic, and the daily charter rate in the charter market has once again exceeded six figures.

According to a number of chartering brokers, French shipping giant CMA CGM has chartered the newly built 7,092 TEU class container vessel Kota Callao for three months at a rate of US$105,000 per day. The vessel, one of six containerships being built by TS Lines at the Waigaoqiao Shipyard in Shanghai, China, will be delivered in the next two weeks and the short-term charter agreement is being executed prior to the commencement of a long-term charter with PIL in Singapore.

Another 1,827 TEU class container vessel, the ‘Adrastos’ (built 2023), owned by Capital Ship Management, has also been chartered to Tailwind Shipping Lines at a rate of USD 40,000/day, almost identical to its sister vessel, the ‘Asterios’. This is almost double the rate of its sister vessel ‘Asterios’ a month ago.

In addition, Nordic Hamburg has entered into a short-term charter agreement with Ellerman City Liners for the 1,380 TEU container vessel BG Orange for a period of 1-2 months at a daily rate of USD 35,000/day.

The demand for short-term charters has increased dramatically, further pushing up charter rates. According to the Howe Robinso Container Index has risen for 23 consecutive weeks to 1,677 points, reflecting the strong performance of the market.

In the long-haul market, daily charter rates also continued their upward trend. In the traditional Panamax segment, the two-year benchmark charter rate has risen to approximately USD 30,000 per day. Greek tonnage provider Danaos Corp secured this rate for the 4,253 TEU container vessel Seattle C (built 2007), which has been extended by COSCO Shipping's Orient Overseas Container Line (OOCL).

Meanwhile, the 4,241 TEU container vessel Navios Vermillion (built in 2007) has been chartered for 24 months at US$29,500/day for delivery in January next year, and the 3,421 TEU container vessel GSL Melina (built in 2007) has been chartered for 24 months at US$29,500/day for delivery in January next year. The 3,421 TEU class container vessel ‘GSL Melina’ (built in 2013) has been chartered by Maersk for two years at a charter rate of approximately USD 30,000/day; the 1808 TEU class container vessel ‘Stephania K’ (built in 2024) has been chartered by OOCL for 24 months at a charter rate of USD 22,000/day. The 1808 TEU class container vessel ‘Stephania K’ (built in 2024) has been chartered by OOCL for 24 months at a rate of US$22,000/day.

The boom in the chartering market is closely linked to the surge in freight rates.

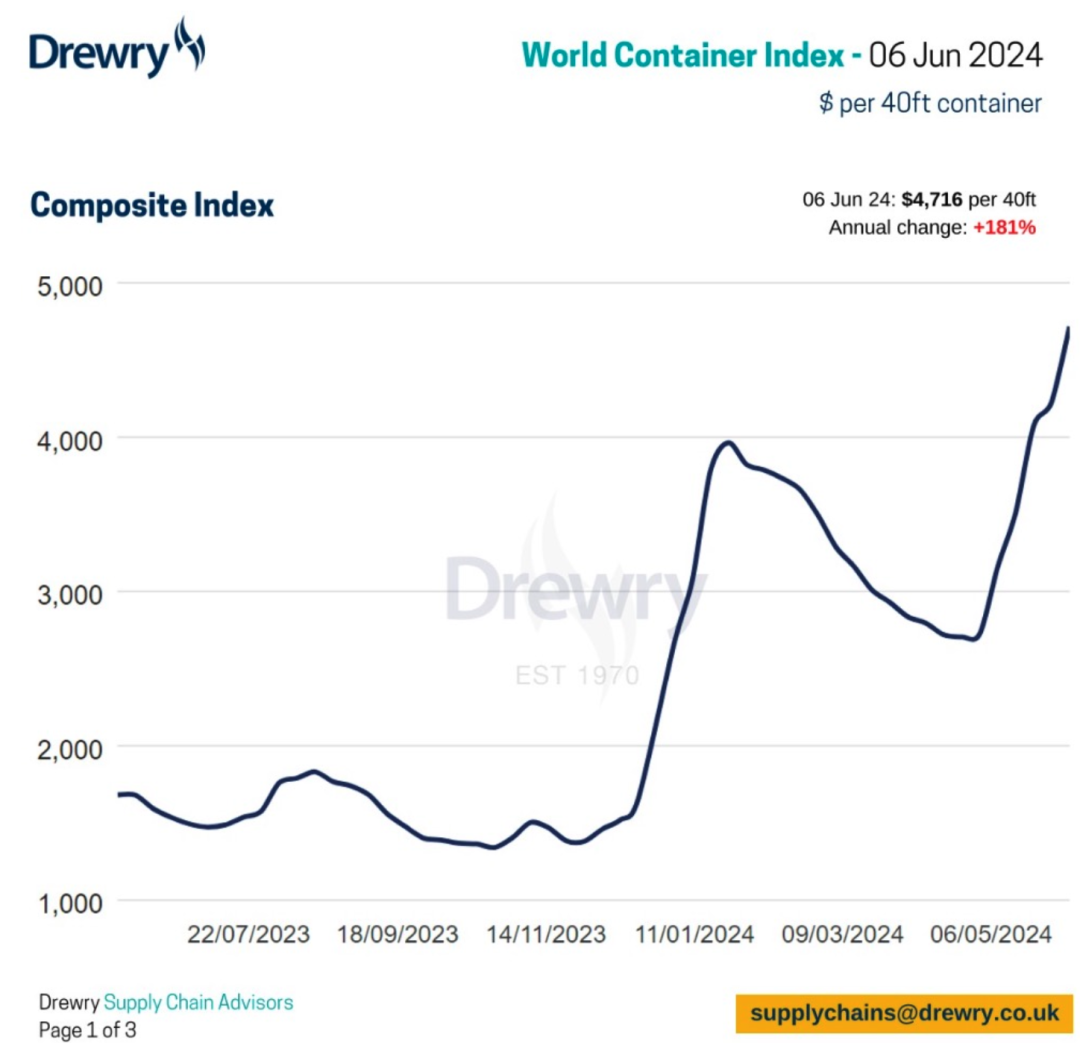

The Drewry World Container Index (WCI) rose 12% to US$4,716/FEU in the week ending 6 June, up 181% compared to the same period in 2022 and 232% above the pre-2019 average of US$1,420/FEU.

Among the routes from China, Shanghai-Rotterdam is up 14 per cent to $6,032/FEU, Shanghai-Genoa is up 17 per cent to $6,664/FEU, Shanghai-New York is up 6 per cent to $7,214/FEU, and Shanghai-Los Angeles is up 11 per cent to $5,975/FEU compared to last week.

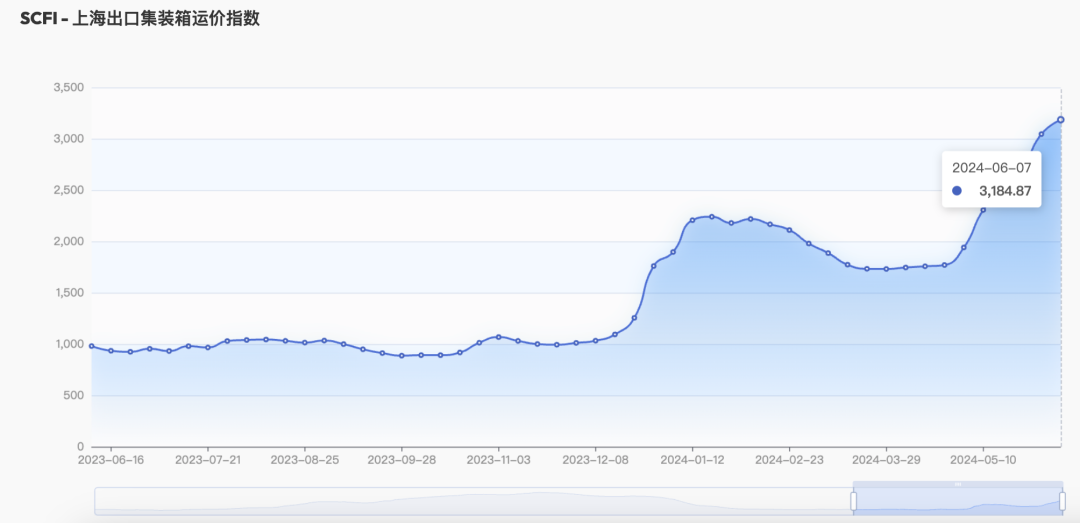

After surpassing the 3,000-point mark for the first time since the boom during the August 2022 outbreak faded, the Shanghai Export Containerised Freight Index (SCFI) continued its upward trend last week, rising 4.6 per cent year-on-year to 3,184.87 points, tripling since the beginning of December last year, data from FreightPower, a subsidiary of COSCO Haike, showed.

On 7 June, the market freight rate (sea freight and sea freight surcharge) for export from Shanghai port to European base port was USD 3,949/TEU, up 5.6% from the previous period. The freight rate from Shanghai port to Mediterranean base port was USD 4,784/TEU, up 1.4% compared with the previous period.

Investment bank Jefferies (Jefferies) pointed out that: ‘The container market remains very tight, with strong demand, capacity constraints, container shortages and congestion in Asian ports leading to a more frantic pace of bookings by shippers and retailers.’

The peak season usually starts in June, but this year it seems to have started earlier than usual due to shippers' anxiety over longer sailing times on Asia-Europe trade routes around the continent as Yemen's Houthis have essentially blockaded the Red Sea.

Since early May, close to 70 per cent of freight forwarders and non-vessel-owning carriers (NVOCCs) with long-term contracts with liner shipping lines have been forced to divert containers to the spot market or renegotiate their contracts with carriers in an effort to raise long-term freight rates, according to a survey by Freightos.

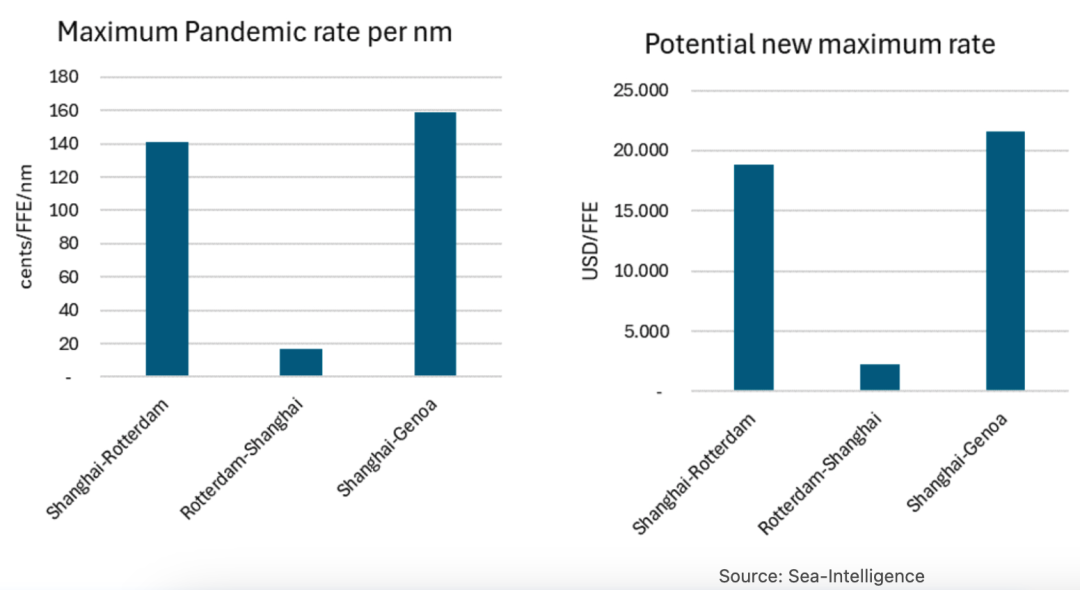

In their latest weekly report, Sea-Intelligence analysts warned that ‘the current rapid spike in freight rates on Asia-Europe routes is remarkably similar to that seen during the outbreak, while longer sailing distances could lead to new all-time highs in rates, well above those recorded during the outbreak.’

Sea-Intelligence analysis shows that if freight rates paid per nautical mile were to reach the same levels as during the epidemic, spot rates from Shanghai to Rotterdam would reach US$18,900/FEU, spot rates from Shanghai to Genoa would reach US$21,600/FEU, and backhaul rates from Rotterdam to Shanghai would reach US$2,200/FEU. while at the absolute peak of the epidemic, Asia-Europe freight rates would have reached a record high. At the absolute peak during the epidemic, freight rates on the Asia-Europe route topped the US$14,000/FEU mark in early 2022.

The liner companies learnt their ‘lesson’ from the outbreak in terms of fast freight rate increases and may repeat it in the current crisis. A number of liner companies are planning to implement peak season surcharges from mid-June, which are expected to push rates on trans-Pacific and Asia-Europe routes up by a further $1,000/TEU.

Shipbroker Braemar said the general positive sentiment continues, with the market believing that favourable trading conditions are likely to continue until the end of the year.

https://www.cnss.com.cn/html/hygc/20240612/353729.html

|