Longer routes are reshaping the oil trade landscape as merchant ships opt to bypass the Cape of Good Hope to avoid the risks of Red Sea waters.

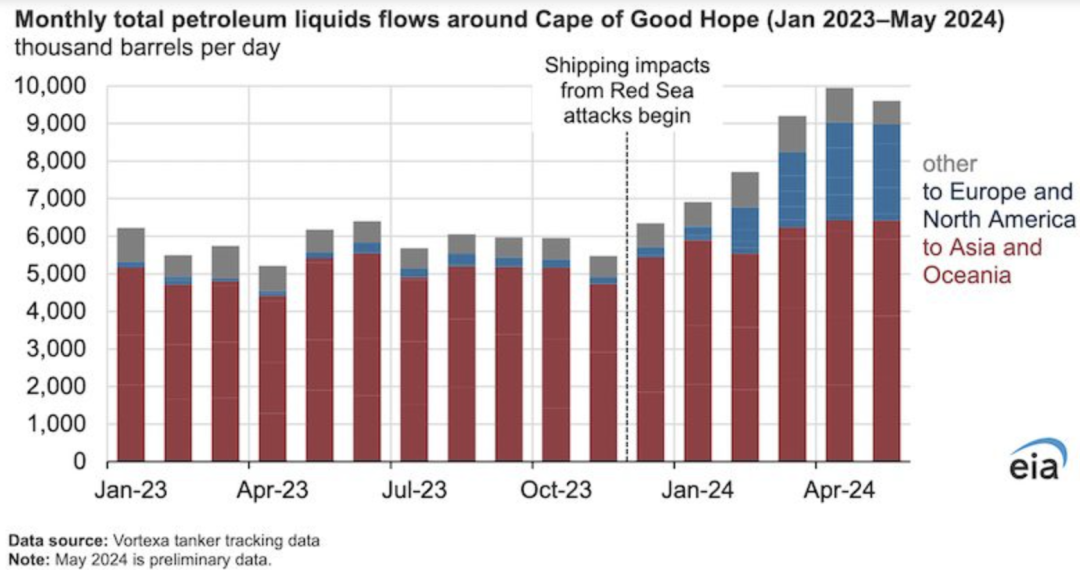

In the first five months of 2024, what had been an average of 5.9 million barrels a day of crude oil and refined products shipped around the Cape of Good Hope has soared to 8.7 million barrels a day, a 47 per cent rise, according to the US Energy Information Administration.

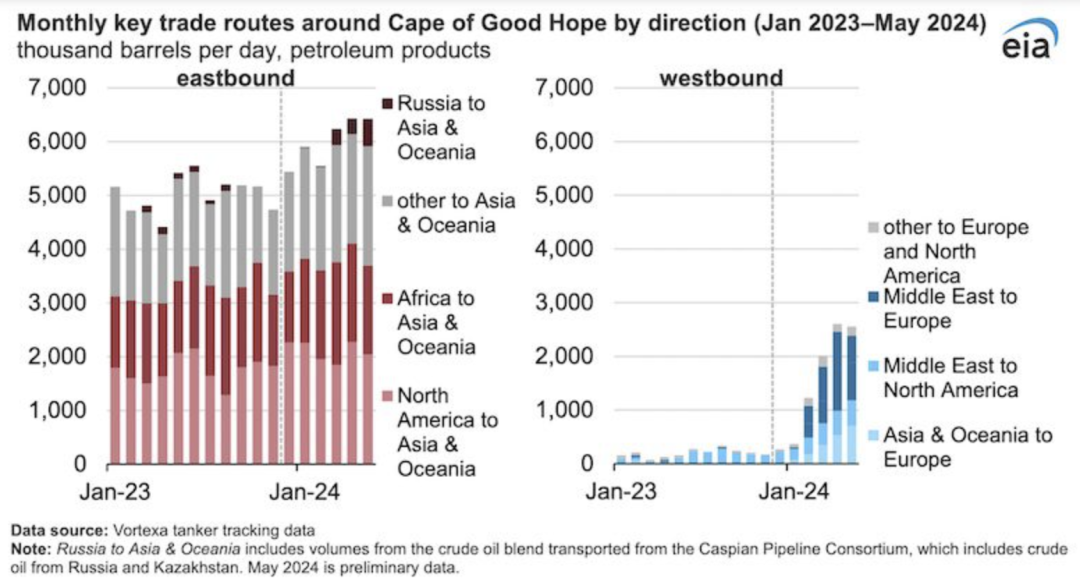

Data from the U.S. Energy Department reveals further details behind the shift. Saudi Arabia and Iraq, the major crude producers in the Middle East, have rerouted crude that would have been destined for Europe around the Cape of Good Hope instead of via the Suez Canal. This diversion accounted for 15 per cent of the total increase. At the same time, refineries in Asia and the Middle East increased their exports of refined products to Europe, contributing 29 per cent of the increase in trade via the Cape of Good Hope Bypass.

The United States has also adjusted its oil trade pattern by beginning to receive more crude oil and refined products from the Middle East and Asia via the Cape of Good Hope, while exporting more refined products to Asia via the Cape of Good Hope. Compared to the 2023 average, total U.S. oil trade through the Cape of Good Hope increased by one-third, to about 600,000 barrels per day.

It is worth noting that Russia's shipments of crude oil and refined products to Asia via the Cape of Good Hope have also quadrupled compared to 2023, despite not being directly affected by the situation in the Red Sea.

The decision to bypass the Cape of Good Hope did not come without a cost. Shipping times have almost doubled, with the journey from the Arabian Sea to Europe via the Cape of Good Hope taking around 15 days longer than via the Straits of Bab al-Mandeb and the Suez Canal, which inevitably leads to higher transport costs and delays in cargoes.

However, geopolitical considerations often take precedence over economic ones. Houthi attacks have deterred merchant shipping companies from taking the risk, making a detour around the Cape of Good Hope a safer solution, even if it means higher costs and longer transit times.

Behind this shipping boom around the Cape of Good Hope is the complex international situation and geopolitical game. Tension in the Middle East is like the ghost of the Strait of Hormuz, always threatening the safety of maritime transport, forcing the global shipping industry to re-examine the security of trade routes.

In the long run, the shipping boom around the Cape of Good Hope may prompt a reshaping of the global shipping landscape. Some trade routes that originally relied on the Suez Canal may shift to the Cape of Good Hope, affecting the interests of related ports and shipping companies. And the changing situation in the Middle East could further intensify geopolitical games and pose a challenge to global energy security.

https://www.cnss.com.cn/html/hygc/20240617/353787.html

|