Spot freight rates have risen sharply recently due to the volatile situation in the Red Sea, forcing shipping companies to detour to Africa. The Shanghai Container Freight Index (SCFI), after 13 consecutive weeks of gains, fell slightly by 1.6 per cent last week to 3674.86 points, breaking its previous upward trend. While the SCFI fell, the Drewry World Container Index (DWCI) slowed to a mere 1 per cent gain after jumping 10,000 points in the previous period. Overall, the market is showing some signs of adjustment after a long period of gains.

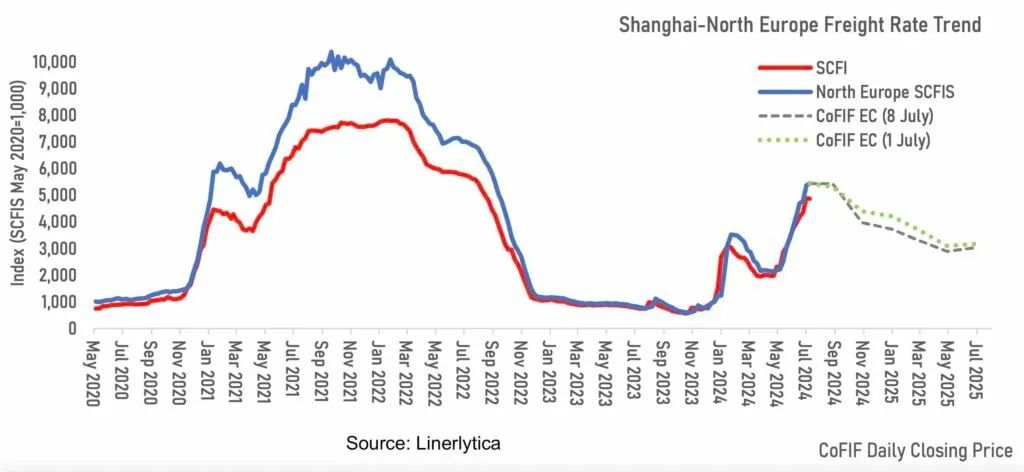

As shippers prepare for a tough bargaining process, the extraordinary boom in the container shipping market appears to be reaching its first turning point in 2024. Asia-based consultancy Linerlytica has issued a warning that freight rates may have peaked, a prediction that was initially validated by this week's decline in the freight futures market (as shown in the chart).

In its latest weekly report, Linerlytica analysed: "While carriers managed to push freight rates up on 1 July, the addition of new capacity on the US West Coast, Northern Europe, South America and the Middle East effectively eased the pressure on these routes, leading to cracks in the ability of shipping lines to raise rates further." Nonetheless, the agency forecasts freight rates to remain high until the end of the peak season, which could extend into September.

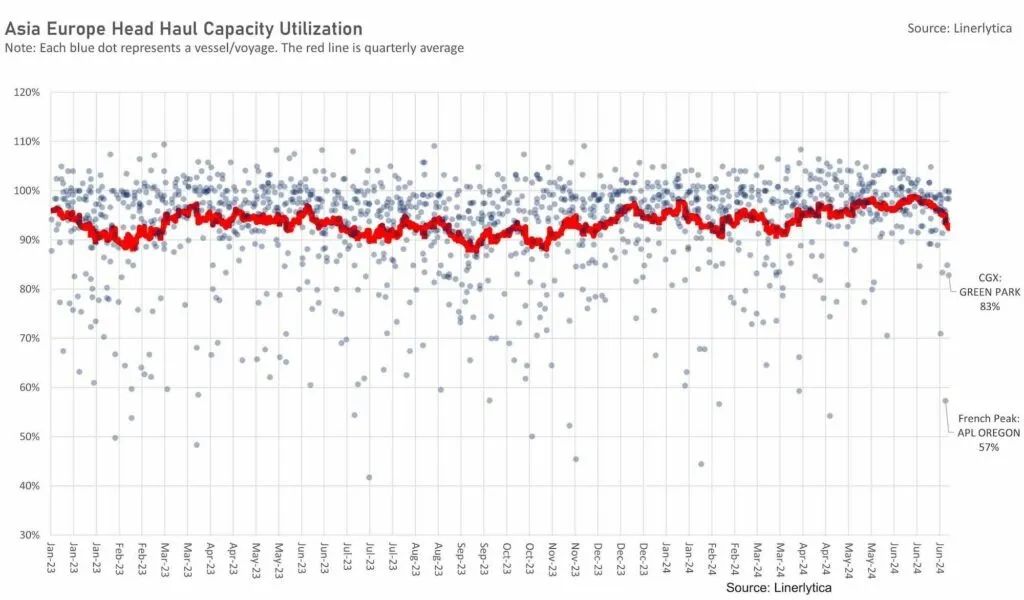

Looking at specific trade routes, the last week-on-week Eurolines Container Freight Index (SCFI) assessment saw its first weekly decline since mid-April, down 0.5 per cent, which was largely attributed to a second consecutive weekly decline in average capacity utilisation, despite a rebound in the latest edition of the Eurolines tariffs.

Johnson Leung, co-founder of Linerlytica, noted that rates on Asia-Europe routes are showing signs of topping out, with freight forwarders securing more slots on new services launched this month. He further explains, "According to utilisation data, last week's new launches on Asia-Europe routes resulted in an unprecedented slump in capacity on Asia routes. utilisation rates on CMA CGM's French Peak and Hapag-Lloyd's CGX are well below the recent average for Asia-Europe routes."

Shipping operators in Asia have expressed concern, with one saying that "shipping companies are collapsing", emphasising that this year's shipping boom is fundamentally different from the one during the New Crown epidemic. A non-vessel operating carrier (NVOCC) executive revealed that although most areas of the tariffs remain firm, but China to the Middle East class tariffs in the past four weeks has fallen by one-third, while Asia to Northern Europe tariffs are "stagnant".

On the trans-Pacific route, investment bank Jefferies pointed out that although Asia to the U.S. West Coast freight rates are still at annual highs, close to $8,000 per foot container, but market indications are that booking prices will fall back to about $7,000 per foot container in late July and August.

A number of experts in the container shipping consultancy space also weighed in, with Lars Jensen, CEO of Vespucci Maritime, suggesting that July is likely to be the peak of the current freight rate hike, barring major new supply chain failures such as increased congestion in the ports, a rail strike in Canada, or a widening of the Red Sea crisis. However, he also warned that the deadlock in contract negotiations for US East Coast dockworkers could trigger a wave of strikes in the autumn, becoming a new round of uncertainty affecting freight rates.

Deutsche Bank analyst Andy Chu, on the other hand, said bluntly that there is a bubble in the current container shipping market, and that the magnitude of the freight rate increase has exceeded historical levels outside of the New Crown epidemic, which is difficult to understand.

Not all analysts are pessimistic, however, with Emily Stausbøll, senior shipping analyst at Xeneta, pointing out that its data suggests that average spot freight rates on key Asia-bound routes will continue to rise in mid-July, coinciding with record global demand for seaborne container shipping in May. She believes spot freight rates will continue to climb as long as shippers feel they must pay more to secure cargo space.

Similar views were expressed by Simon Heaney of UK-based consultancy Drewry and Dan Nash of Veson Nautical, who argued that freight rates will be affected by the level of congestion at ports and the availability of equipment, and that current demand remains strong and is not expected to change fundamentally during the year.

In addition, while congestion in Singapore's ports has continued to ease since May, with vessels waiting significantly less time for berths, ports elsewhere, such as near the Cape of Good Hope, have experienced disruptions to container traffic due to poor weather conditions, further complicating global shipping.

https://www.cnss.com.cn/html/hygc/20240716/354064.html

|