Owned ships - the choice of global shipowners

The latest data released by Alphaliner last week reveals the choice of global container ship owners.

Israel's Star Line (ZIM) topped the list of the world's top 10 liner shipping companies in terms of capacity growth rate, achieving a 17.5 per cent increase. According to the latest data from Alphaliner, Star Line's capacity has grown further to 728,000 TEU.

Following ZIM is German container ship owner Hapag-Lloyd in second place with a 10.6 per cent increase in capacity, while Korea Marine Marine Marine (HMM) and MSC follow with growth rates of 7.3 per cent and 7.1 per cent, respectively, and Japan's Oceanic NetLink Shipping (ONE) is in fifth place with a growth rate of 6.3 per cent.

In contrast, as Taiwan's container three heroes of Yang Ming Shipping, its capacity has decreased by 2%, is the world's top ten container shipping companies in the only company with negative growth in capacity. The 2 per cent decrease is said to be mainly due to a contract signed last year to charter a 14,000 TEU container vessel to Maersk Line for one year this year.

But on the other hand, Yang Ming Marine has increased the proportion of owned vessels from 31.6 per cent to 45 per cent in just two years through strategic adjustments, namely buying long term chartered vessels. It is reported that Yang Ming Marine has added eight new owned vessels since last year, as well as two more vessels that are planned to be added through charter to purchase in the near future.

From the figures, Yang Ming Marine has made significant progress in the proportion of owned vessels. In September 2022, the proportion of owned vessels was only 31.6%, but by October last year it had risen to 35%, and by the end of June this year it was as high as 45%. In terms of number of vessels, of the company's 94 vessels, 58 or 61.7 per cent are owned, compared to 36 chartered-in vessels.

Star Shipping, on the other hand, relies heavily on chartered vessels and currently has only nine owned vessels, but the company has a number of new vessels under construction.

Ownership ‘reform’ in the shipping industry

When it comes to why today's shipowners are collectively choosing to increase their own ship holdings, it's important to mention a time when many shipowners were making a lot of money.

Container liners were in the spotlight for significant revenue growth during the new pneumonia pandemic, while the container ship chartering market achieved record earnings in a more subdued state. Globally, about half of the fleet composition of liner companies is company-owned, while the remaining half relies on services provided by ship charterers or independent shipowners.

From 2021-2022, liner companies are in dire need of capacity, and the more vessels they have access to, the higher their earnings. Ship charterers typically dominate the terms of the charters and therefore sign charters that exceed the needs of the liner companies and push the charter rates up to historical peaks. There was a time when some boxships were chartering at six figures per day.

For a long time after that, ship charterers remained less affected by the fall in demand than the liner companies, and they will be protected by their charters until 2024. But for those liner operators who already have plenty of cash flow, they are no longer satisfied with being ‘at the mercy of others’ and are choosing to take capacity into their own hands in a wave of ‘reforms’ that will increase the number of free ships.

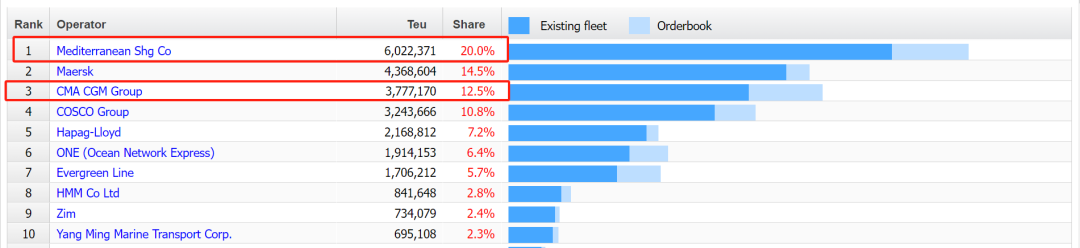

Since 2020, MSC, as a well-known ‘capacity-buying enthusiast’ in the industry, has not only ordered as many as 88 new vessels, but also acquired 355 second-hand vessels with large sums of money, and the scale of its ship purchases is unrivalled in the industry. Ten years ago, more than 60% of MSC's fleet was chartered, but today, with the proliferation of owned vessels, this ratio has been significantly reversed, with only 36% of the vessels chartered. The size of the fleet operated by MSC has now jumped to 6.02 million TEUs, a doubling from 2.4 million TEUs a decade ago.

Alphaliner further points out that given the complexities and grey areas of MSC's extensive use of purchase options or obligations in bareboat agreements, particularly in the procurement of large newbuildings, the proportion of vessels actually or ultimately owned by MSC may have crept up to more than 70%.

Meanwhile, CMA CGM has embarked on a major expansion of container tonnage to support the rapid growth of its fleet. Currently, CMA CGM's fleet size has reached 3.77 million TEUs. Looking back ten years ago, only 20 per cent of the French shipping giant's fleet was owned, while the proportion of chartered vessels was as high as 80 per cent. Not to be outdone, however, CMA CGM has not only ordered at least 80 new vessels, but has also acquired no less than 112 second-hand vessels. As the fleet continues to grow, Duffy's proportion of owned vessels has increased to 40 per cent.

In Asia, HMM has also undergone a remarkable transformation.

The company decisively adjusted its business model after the market turmoil of 2016, exiting the expensive charter business and instead working on building a modern, large-scale owned fleet. Today, HMM's owned tonnage accounts for more than half of its fleet, up from 30 per cent a decade ago. Its fleet size has grown to 816,077 TEUs, and the percentage of owned tonnage has increased from 30 per cent to 55 per cent.

Chinese shipowners continue to gain momentum

In addition, China's SITC Container Line has shown remarkable resilience. Once reliant on chartered vessels, the company has achieved the feat of being virtually charter-free in recent years. in 2014, half of SITC's fleet was still chartered; today, the proportion of owned vessels in its 162,614 TEU fleet is as high as 95 percent.

Thanks to the rise of Chinese-funded financial leasing companies in the ship chartering market, the size of China's owned fleet has reportedly grown dramatically to become the world's second-largest ship-owning country after Greece, and with the growth in orders, China has overtaken Greece to become the world's largest ship-owning country.

Data shows that as of today, the size of the fleet held by Chinese shipowners has reached 249.2 million gross tonnes with a market share of 15.9% (the value of the Chinese owner's fleet is about $180 billion), slightly higher than the Greek owner's 249.0 million gross tonnes and market share of 15.8% (the value of the Greek owner's fleet is about $163 billion). Japan is in third place with 181.0 million gross tonnes, followed by South Korea and the US with about 66 million gross tonnes each.

The report said the leading fleet size of Chinese shipowners is mainly due to the growth of the dry bulk and container fleets. Clarkson data shows that Chinese shipowners have a 24 per cent gross tonnage share of the dry bulk fleet and a 16 per cent gross tonnage share of the container fleet.

Chinese shipowners are reportedly very active in the newbuilding market because of their advantages in terms of cargo size, shipbuilding and finance, and currently hold almost twice as many orders as Greek shipowners.

https://www.cnss.com.cn/html/sdbd/20240730/354210.html

|