In recent years, India's role in the global crude oil market has undergone a dramatic change, especially in its crude oil trade with Russia. This phenomenon is not only a product of geopolitical changes, but also a microcosm of the reshuffling of the global energy map.

India: From Energy Dependent to Market Trader

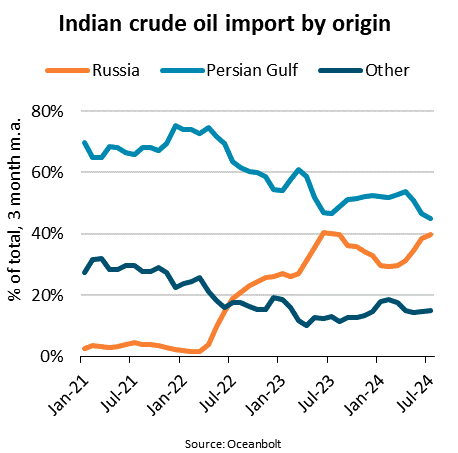

India now imports 40% of its total crude oil from Russia, with imports averaging a whopping 1.6 million barrels per day (bpd) so far this year, a 1,000% jump from 2021, according to BIMCO. That leap began in 2022, after the outbreak of the Russo-Ukrainian war, when the West imposed tough economic sanctions on Russia.

Prior to the sanctions, the European Union and the United States accounted for about 65% of Russia's seaborne crude exports, however, the sanctions forced Russia to look for new buyers, and India became the biggest beneficiary of this market transformation. With a keen eye for discounted Urals crude, India quickly filled the void left by the West's withdrawal. This not only reduced India's import costs, but also strategically diversified its energy imports, making India the world's largest buyer of Russian crude by mid-2023.

Notably, India's access to Russian oil comes at the same time as its crude imports from Persian Gulf countries have plummeted from nearly 70% to 45%. Crude oil resources from these Persian Gulf countries were then reallocated to the Northern European and Mediterranean markets. This shift in India's purchasing pattern has not only given it a more prominent position on the global energy map, but has also changed the global crude oil shipping landscape.

Far-reaching implications for global shipping markets

India's surge in Russian crude oil imports has not only shifted market share, but has also brought about profound changes in the global shipping market. bimco notes that this change has led to a 10% increase in the average distance sailed by crude oil tankers globally, and an 8% increase in gross tonnage nautical miles (gtn), even though the volume of shipments has declined by 2%. The 25% increase in average voyage distance compared to 2021 means that the overall operational efficiency of the shipping industry is undergoing profound changes.

More significantly, this shift in India's procurement patterns has also directly impacted the structure of tanker utilization. Currently, Aframax and Suezmax tankers account for 55% of India's imports, while the use of VLCCs has declined. This change has also led to an increase in the average age of tankers received by India by four years, with the proportion of tankers over 20 years old increasing from 2% to 13%.

This series of shifts highlights the complexity and volatility of the global energy trade and transportation landscape. As the world's third largest energy consumer, India's moves in the crude oil market will not only affect the supply and demand balance in the tanker market, but will also have a knock-on effect on global energy prices.

Future direction of India's energy strategy

BIMCO expects that trade between Russia and India is likely to continue at current levels despite the current backdrop of sanctions, but the International Energy Agency (IEA) has noted that India's growing demand for oil could outstrip Russia's supply capacity. This prediction means that India may have to seek new sources of supply in the future to meet its rapidly growing energy needs.

In this context, India's energy strategy will further test its ability to maneuver in the global energy market. Whether India can continue to capitalize on the low price advantage of Russian oil while exploring new supply channels will have a direct impact on the sustainability and stability of its economic development.

From the perspective of the global shipping market, India's strategic energy shift has not only reshaped the transportation landscape of the tanker market, but also presented new challenges to global shipping companies. How to remain flexible and competitive in a changing market will be a key topic in the coming years.

In the view of Maritime Circle Focus, India's energy strategy in the wake of the Russia-Ukraine conflict is more than just a market opportunity to capitalize on, it is also an increase in its energy security and geopolitical influence. In the redrawing of the global energy map, India has shown great adaptability and strategic foresight. However, the sustainability of this strategy remains a challenge, especially in the context of possible further changes in the global energy supply landscape in the coming years.

The future development of the shipping industry, as the hub of global trade, will be closely linked to the direction of India's energy strategy. In the face of changing energy import patterns in India, global shipping companies will have to quickly adapt their operational strategies to respond to changing market demands. In this era of uncertainty, the only way to be invincible in the global energy and shipping markets is to be proactive and react quickly.

https://www.cnss.com.cn/html/sdbd/20240809/354304.html

|