With weak oil demand from China and geopolitical tensions in the Middle East continuing to fester, the global crude oil market is standing at a crossroads. With the shadow of oversupply looming ahead and traditional demand drivers being eroded by the new energy revolution, the industry as a whole faces unprecedented challenges.

In its latest report, shipbroker Gibson said that recently, the news surrounding the crude oil market has centred on two main areas: weak oil demand from China and conflict in the Middle East threatening supply. As it stands, the impact of slowing demand appears to be outweighing the impact of geopolitical tensions. The market could come under further pressure in 2025 as significant new oil supplies enter the market.

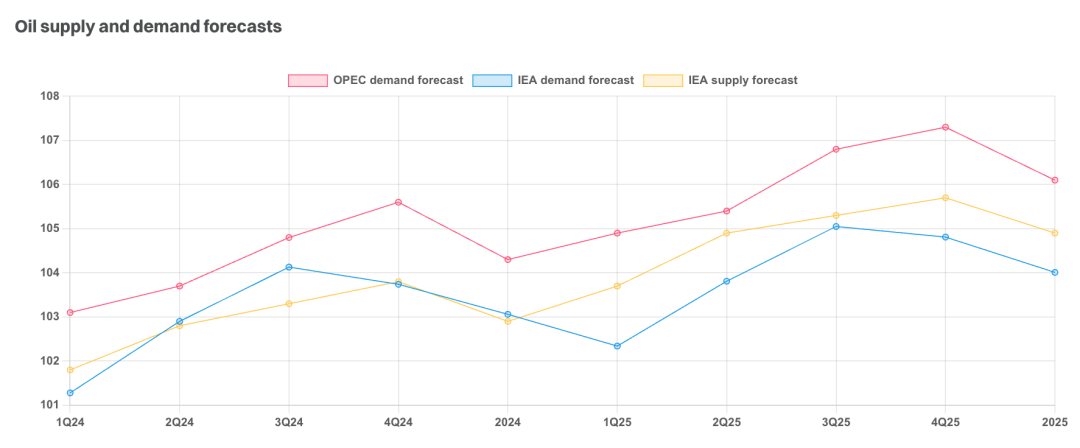

OPEC+ recently cut its demand growth forecast for this year to 2.11 million bpd. gibson said that despite being halfway through 2024, the agency's expected growth has not been realised and further downward revisions to its forecasts may be needed. The International Energy Agency (IEA) is more conservative in its expectations, projecting demand growth of 970,000 b/d in 2024 and 950,000 b/d in 2025.

These figures contrast with the supply outlook, which Gibson says will continue to grow in North America and Latin America through 2025, with the US and Canada alone contributing an additional 740,000 b/d. In Latin America, crude production continues to strengthen in Brazil and Guyana, which are expected to add 290,000 b/d by 2025, and 100,000 b/d in Guyana. Incremental supply from non-OPEC+ countries is expected to reach 1.5 million b/d, while OPEC+ countries will contribute 400,000 b/d while maintaining voluntary production cuts.

As a result, the IEA expects an additional 1.9 mb/d of crude supply to enter the market next year.OPEC+'s current stance is to gradually ease supply constraints from October onwards, with an expected increase of up to 227,000 b/d from January onwards, and by November 2025, the full 2.2 mb/d of the cuts made in January of this year will be restored. As a result, total supply growth is likely to be higher.

Demand growth is largely centred in Asia, meaning that most of the new supply will be used for long-haul exports. However, 320,000 b/d of the additional demand forecast by the IEA for 2025 is expected to come from China, but it remains uncertain whether this will materialise.The IEA had projected 500,000 b/d of demand growth from China in 2024, but revised it down to 300,000 b/d in its latest report.

According to Bloomberg, China's crude imports fell by 3 per cent year-on-year in the first half of 2024, with 7 per cent of that (or 800,000 b/d) being used to fill strategic reserves. This could indicate that real demand estimates could fall further unless some form of stimulus is introduced. One of the biggest drivers of weak demand in China is the popularity of new energy vehicles, represented by LNG and electric vehicles. in July 2024, sales of such vehicles accounted for more than 50 per cent of total retail sales for the first time.

Overall, the IEA expects the market to be oversupplied in 2025 by around 850,000 b/d. The long-term projects of most producers mean that they are unable to cut production to stabilise prices, and so far only OPEC+ has been willing to play that role. US shale producers have the ability to make short-term supply cuts, but it is not clear at what price point they will reduce production.OPEC+ has hinted that they may extend their cuts to stabilise the market if demand continues to be weak.

Gibson believes that Iraq, Kazakhstan and Russia are already producing above quota and have agreed to further supply restrictions to comply with production targets. Further non-compliance could cause conflict within the organisation, with OPEC+ currently holding a total of 7.5 million b/d of spare production capacity. If demand grows less than expected and OPEC+ members are unable to continue restricting supply, the market is likely to be oversupplied in 2025. This could spur an increase in storage demand, perhaps on tankers in extreme cases.

https://www.cnss.com.cn/html/hygc/20240827/354433.html

|