With the imminent dissolution of the 2M alliance in 2025 and the establishment of the Premier alliance, the alliance pattern of the global container shipping market is facing reshaping, and Mediterranean Shipping Company (MSC), the world's No.1 liner company that adheres to independent operation, is attracting a lot of attention at this time.

A few days ago, MSC CEO Soren Toft (Soren Toft) in an interview with the media, elaborated on MSC's strategic positioning and future development plans.

Soren Toft, Chief Executive Officer of MSC

From February 2025, MSC will officially launch its new east-west independent transport network. In this regard, Søren Toft explained, ‘This is to demonstrate the strength of MSC's service network.’ He further stated that MSC is ready for the market changes.

Under MSC's latest standalone transport network, 34 services will be deployed in five key trade markets, replacing the existing 2M pooling agreement with Maersk, and two through-vessel options via the Suez Canal and the Cape of Good Hope will be introduced to provide a full range of east-west trade routes.

Regarding the two through-air options, Soren Toft said that when transporting cargo, it is not known whether the Suez Canal route is open or not, so it is done out of caution.

He also highlighted, ‘We think it is very important that MSC now remains an independent operation.’

According to Søren Toft, MSC has the fleet and the strength to achieve this, as it allows MSC to operate with more flexibility and agility, with faster decision-making, which are exactly what customers and the market need.

Although the current market for containerised transport is facing a number of challenges, for Søren Tofte on the future market outlook, but still maintain a cautiously optimistic attitude, he said: ‘We do not see any signs of market decline, we think the demand outlook is quite optimistic.’

While emphasising its independent operations, MSC still maintains co-operation with a number of liner shipping companies.

MSC has announced a slot exchange co-operation with the fledgling Premier Alliance. The co-operation will be effective from February 2025 and will cover Asia-North Europe and Asia-Mediterranean trade routes.

According to MSC, the co-operation focuses on strategic slot swaps on a number of key routes to further enrich its own independent service network.

At the same time, MSC has also entered into a new long-term operational co-operation agreement with Star Line on the Asia-U.S. East Coast and Asia-U.S. Gulf routes, which will also start in February 2025, the two companies said.

The two parties said the new co-operation will result in more comprehensive port coverage, providing customers with more transport options and better service, while also improving operational efficiency.

Ship-sharing agreements are understood to be designed to maximise capacity utilisation while reducing costs against the backdrop of unstable global trade. But as the market changes, liner companies have different considerations.

On 25 January 2023, Maersk and MSC jointly announced that they have agreed to terminate the 2M Alliance operations from January 2025 onwards. Both parties said that many things have changed since the partnership and that terminating the 2M Alliance operations will pave the way for the two companies to pursue their respective strategic developments.

In order to pave the way for independent operations, MSC has been very active recently in shipbuilding, new routes and acquisitions.

According to statistics from Alphaliner, MSC has ordered more than 30 new vessels and purchased several second-hand containerships in recent months.

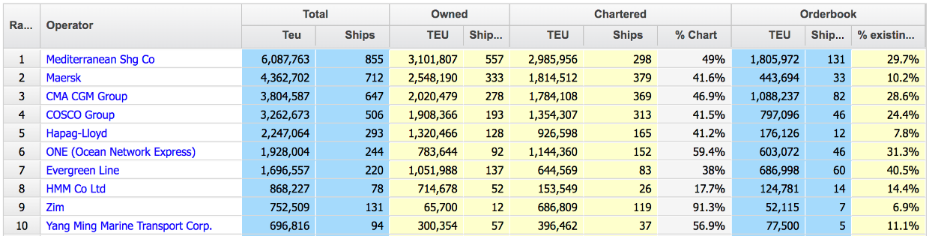

Alphaliner's latest stats (as of 13 September 2024)

Alphaliner's data shows that as of 13 September, MSC's total operating capacity was close to 6.09 million TEUs, with a total of 855 vessels in operation, accounting for 20% of the global capacity market share. Among them, 557 owned ships and 3.1 million TEU, 298 chartered ships and 2.99 million TEU, and 131 ordered ships and 1.81 million TEU.

In addition, MSC has recently launched a number of new routes involving the Asian market.

Including connecting Asia and Mexico's major ports MEXICAS loop service, Asia to the Middle East independent route CLANGA, Asia to the southeastern region of India's OSPREY weekly routes and so on.

It is understood that MSC currently has more than 300 trade routes around the world, calling at more than 520 ports.

In addition to new routes, MSC subsidiary MEDLOG recently acquired the UK's largest land transport company Maritime Transport.

Commenting on this, Soren Toft said, ‘This transaction will add Maritime Transport to the MSC family, which is vital to expanding MSC's presence in the UK.’

Currently, MSC is strengthening its operational independence and flexibility to meet the new challenges of the market, based on a large scale of capacity.

https://www.cnss.com.cn/html/figure/20240914/354592.html

|