|

|

|

|

|

|

|

International Cooperation Department

Tel.: (+86-21) 65853850-8034

Fax: (+86-21) 65373125

E-mail: ICDept@sisi-smu.org

|

|

|

|

|

International Shipping |

|

| HMM expands in a big way to catch up with rivals with $17.5bn investment! |

|

Date:2024-09-16 Readers:

|

Hyundai Merchant Marine (HMM), South Korea's largest ocean carrier, said Tuesday it will invest 23.5 trillion won ($17.5 billion) by 2030 to nearly double its cargo capacity and expand its integrated logistics services, thereby transforming itself into a full-service logistics solution provider and moving away from its traditional business model, which relied solely on fleet expansion and competitive freight rates, the South Korean media reported. The company's business model is based on fleet expansion and competitive freight rates.

The investment will be spread across four key areas: container business (US$9.4bn), bulk cargo business (US$4.14bn), integrated logistics business (US$3.11bn) and environmental and digital business (US$0.74bn). More than 60 per cent of the total investment (US$10.66 billion) will go towards sustainable management initiatives, including low-carbon ships and green facilities.

HMM president and CEO Kim Kyung-bae told a news conference that the company aims to expand its container fleet from the current 83 ships to 130 ships by 2030, reaching 1.55 million TEUs from the current 920,000 TEUs, and plans to purchase about 70 green ships. Just last month, HMM spent $60.5 million on three 19-year-old feeder containerships.

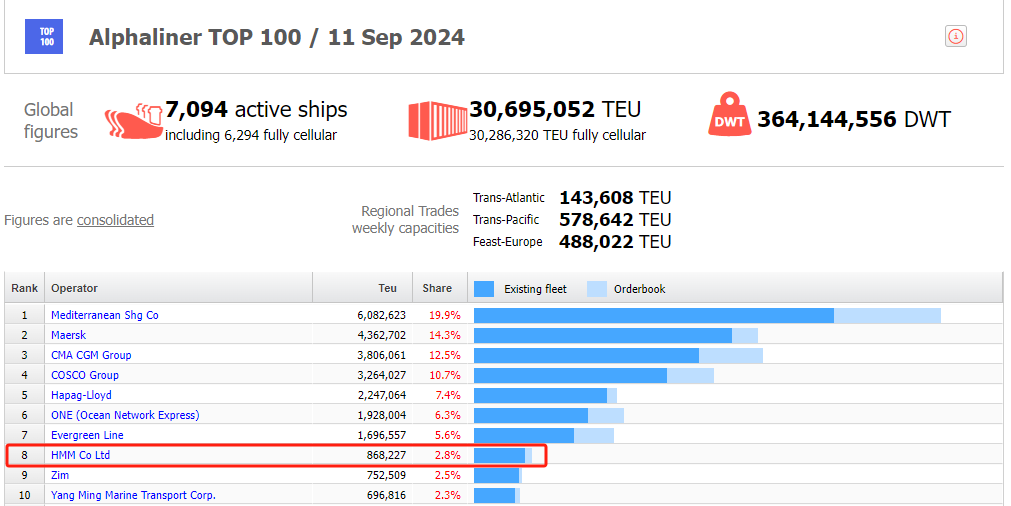

According to the latest Alphaliner data, HMM's capacity is currently ranked eighth globally, with a 2.8 per cent market share in container shipping. Its goal is to grow and compete with the world's shipping giants.

HMM also plans to significantly expand its bulk carrier business over the next few years to strengthen its portfolio in preparation for a prolonged recession. The company has decided to scale up its bulk carrier business, which currently has 36 vessels and 6.3 million deadweight tonnes, to 110 vessels and 12.28 million deadweight tonnes by 2030.

HMM will also expand new port terminals and container storage facilities in its end-to-end business, laying the groundwork to enter the full logistics market.

Kim Kyung-bae said, ‘By 2030, we will achieve revenues of KRW 15 trillion (about US$11.2 billion) and assets of KRW 43.2 trillion (about US$322 trillion), making us the leading logistics company in Korea.’ Its revenue and asset targets are 82.9 per cent and 68 per cent higher year-on-year, respectively.

In response to global environmental goals, HMM is simultaneously considering accelerating its goal of achieving net-zero carbon emissions by 2045. To achieve this, HMM will spend $740 million on retrofitting ship engines, securing a supply chain for green fuels, and improving operational efficiency through digitalisation.

However, sources close to the South Korean shipping industry have warned that HMM's financial targets could be affected by its majority shareholder's plans to privatise the company. Last year, two of HMM's major shareholders, the Korea Development Bank (KDB) and the Korea Ocean Business Corporation (KOBC), planned to sell their shares in HMM for $4.8bn to a consortium comprising Harim Group, South Korea's largest poultry processor, and private equity JKL Partners (Harim-JLK Consortium). However, in February this year, the sale fell through due to ‘disagreements over certain issues’.

Only six months later, HMM launched this aggressive investment programme. While there is a possibility that the sale process could be restarted, HMM's leadership has decided that a reactive approach is no longer viable, given that both the Gemini and Premier Alliances will come into effect next February and that competitors will be taking the opportunity to rapidly ramp up their investments. The announcement comes after HMM this week entered into a five-year strategic partnership (Premier Alliance) with Singapore's Ocean Network Express (ONE) and Taiwan's Yang Ming Marine Transport. The three-way partnership, which will be launched in February 2025, will see Germany's Hapag-Lloyd leave THE Alliance to join the ‘twin-star’ alliance with Maersk.

Premier Alliance will also cooperate with Mediterranean Shipping Company (MSC) in the exchange of space, which will start in February next year. A shipping industry official said, ‘Now that Premier Alliance has joined forces with MSC on transpacific and Asia-Europe routes, HMM will need to build its competitiveness on routes outside Europe, such as the Atlantic, South America and Africa.’

The logistics crisis during the epidemic has certainly fuelled this investment programme for HMM. Labour shortages at ports, overlaid with strikes at major US ports, further exacerbated logistical bottlenecks, causing cargo to be stranded at ports. This situation is directly contributing to increased demand for companies that can fully manage logistics services from start to finish. As a response strategy, shipping companies have been active in mergers and acquisitions, buying up land logistics companies (covering truck and rail transport) and air logistics companies. The profits they earned during the epidemic, ranging from trillions to trillions of won per year, have bolstered HMM's strategic transformation initiatives.

Kim Kyung-bae said, ‘We are improving the quality of services we provide to our customers by strengthening trust-based partnerships. We will also continue to work on developing a resilient business portfolio and positioning ourselves as a global leader in the future of environmentally friendly shipping.’

https://www.cnss.com.cn/html/hyqy/20240912/354565.html

|

|

Back:

China's Top 500 Enterprises in 2024, 9 port, shipping and logistics companies on the list

Back:

China's Top 500 Enterprises in 2024, 9 port, shipping and logistics companies on the list

Next:

Ship Recycling Fundamentals Remain Shaky

Next:

Ship Recycling Fundamentals Remain Shaky

|

|

|

|

|

|

|