The effects of the US 25% tariffs announced on Chinese steel and aluminum products is already seeing destabilizing effects on ship recycling markets, says cash buyer GMS.

“It remains unsure as to where much of this surplus / excess and resultingly cheaper steel will end up, devastating ship recycling prices.”

Compounding market uncertainties have taken center stage, says GMS, with President Trump’s “uncalculated tariff wars sending economies rocking this week, unintentionally targeting the U.S. dollar as the beneficiary to a crisis that is still unfolding, sending it into a tizzy as it declined against nearly all of the major ship recycling destinations, except? You guessed it, Turkey, where it plummeted nearly 0.5% this week, creating an all-time record low.”

Downward pressure on tabled prices has remained unrelenting since the start of the year and the ongoing and intolerable performances of key fundamentals has continued to push levels down ever since USD 600/Ton was achieved back in January 2024. Flatlining steel plate prices across the board including declining levels from India that have fallen in excess of $11/ton over the course of two weeks alone, has done little for prevailing offerings.

Over the course of last year, both India and Pakistan were rigorously subjected to the import of cheaper Chinese steel imports that kept undercutting local inventories, resulting in sub-continent steel markets collapsing. Although new duties by both governments to curb the ill effects of this cheaper steel via anti-dumping tariffs were introduced, there remains a great deal of nervousness as to how these latest rounds of tit-for-tat tariffs will end up hitting the ship recycling industry.

As recycling markets have deteriorated by nearly $30/LDT over the course of this year already, a drop that looks determined to increase, it has been an unexpectedly gloomier picture for the first seven weeks of 2025 despite the bullish start to the year that saw numerous LNG carriers and at least 10 Panamax bulkers from the Chinese / Far Eastern markets concluded for a recycling sale.

As such, questionably interesting times lie ahead, all of which could see a landmark year for ship recycling, with yards still in the process of being upgraded to Hong Kong Convention standards in both Bangladesh and Pakistan, ahead of the convention’s entry into force post June 30th of this year, and Pakistan ending the week with its only delivery of the year.

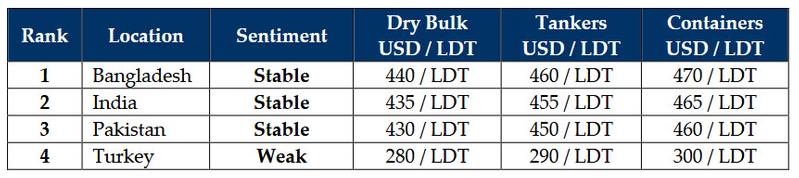

GMS demo rankings / pricing for week 7 of 2025 are:

https://www.marinelink.com/news/tariffs-destabilizing-ship-recycling-522401

|