|

|

|

|

|

|

|

International Cooperation Department

Tel.: (+86-21) 65853850-8034

Fax: (+86-21) 65373125

E-mail: ICDept@sisi-smu.org

|

|

|

|

|

International Shipping |

|

| Great Lakes Limestone Shipments Slip Slightly in July Amid Mixed Port Trends |

|

Date:2025-08-11 Readers:

|

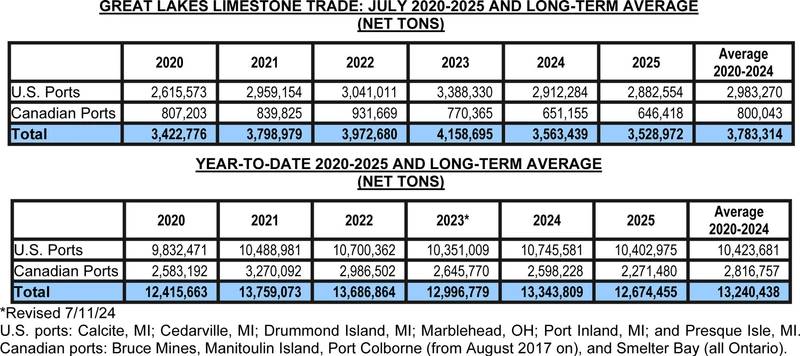

Shipments of limestone across the Great Lakes held relatively steady in July 2025, totaling 3.53 million tons — a fractional drop of less than 1% compared to the same month last year, according to the Lake Carriers’ Association (LCA). Despite the minimal year-over-year change, the trade fell 6.7% short of the month’s five-year average, reflecting softer demand from some key markets.

Loadings from U.S. quarries, which supply the bulk of the region’s limestone, reached 2.88 million tons in July, down 1% from 2024. Canadian shipments showed a similar pattern, easing slightly to 646,418 tons. The overall stability in monthly totals masks a more pronounced year-to-date slowdown.

Year-to-Date Downturn

Through the first seven months of 2025, the Lakes limestone trade stands at 12.67 million tons, a 5% decrease compared to last year. U.S. ports — including major Michigan and Ohio load points such as Calcite, Cedarville, Port Inland, Marblehead, and Presque Isle — have handled 10.40 million tons so far, off 3.2% from 2024. Canadian ports, including Manitoulin Island and Bruce Mines, saw a sharper decline of 12.6%, moving 2.27 million tons.

When compared against the 2020–2024 five-year averages, the 2025 season is lagging by more than half a million tons. Analysts point to a combination of factors, including fluctuating construction demand, weather-related shipment delays earlier in the season, and vessel scheduling adjustments.

Market Implications

Limestone is a vital raw material for the Great Lakes economy, supporting steel manufacturing, construction aggregates, and environmental applications. While the modest July dip suggests relative stability in short-term demand, the year-to-date decline — particularly from Canadian sources — could signal a tightening in supply lines or a shift in market consumption patterns.

The industry will be watching closely as the shipping season heads into its late-summer and fall peak. If construction and steel output remain steady, carriers may be able to close some of the year-to-date gap. However, with 2025 tracking below both last year’s pace and the five-year average, a full seasonal rebound appears unlikely without a demand surge.

https://www.marinelink.com/news/great-lakes-limestone-shipments-slip-528838

|

|

Back:

Ship Recyclers Face Confusing Fundamentals and Market Uncertainty

Back:

Ship Recyclers Face Confusing Fundamentals and Market Uncertainty

Next:

IMO Launches Regional Office in Fiji

Next:

IMO Launches Regional Office in Fiji

|

|

|

|

|

|

|