Spurred by the strong freight market brought about by the Red Sea crisis, the price of second-hand tankers has "risen". However, shipbroker Allied Shipbroking (hereinafter referred to as "Allied") believes that the price may be about to usher in a downward adjustment.

In its latest weekly report, Allied said: "Improving freight market conditions typically stimulate activity in the buy and sell vessel market and lead to upward pressure on asset values. However, in many cases, this positive correlation fails. We can see an increase in sales volumes and a rise in ship prices while freight rates are falling, or a stagnant market for buying and selling ships while ship prices remain relatively high. The ambiguity of cause and effect in the shipping market leaves more room for new ideas. In other words, liquidity in the bid-ask market is not always a reliable indicator of good freight rates, and any strong trend in the price level of an asset is usually a sign of a long-term change taking place that may be more than just a cyclical buying spree."

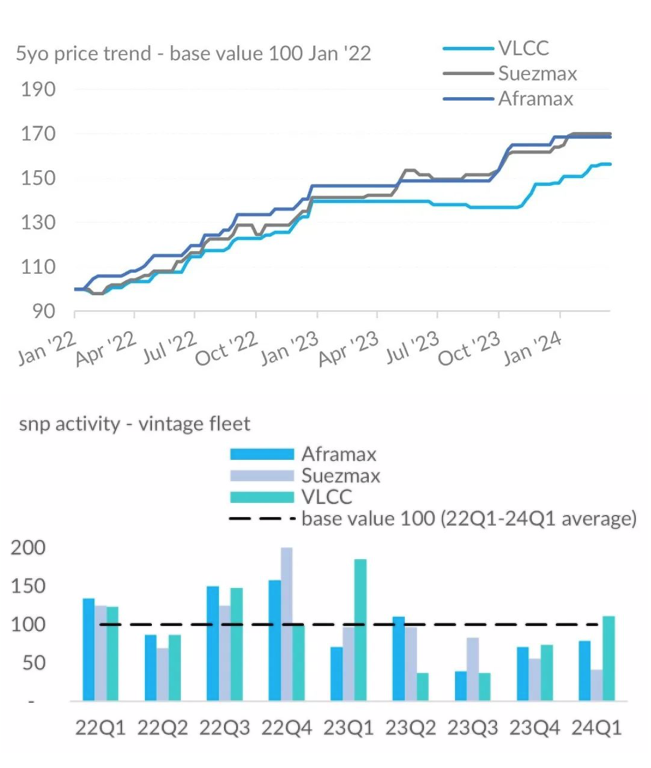

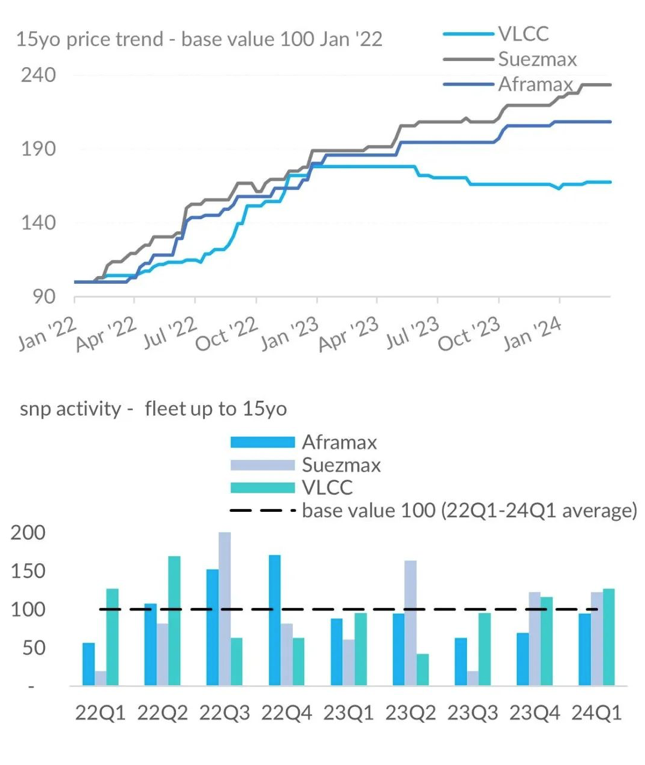

Allied has analysed the tanker sale and purchase market activity in recent years by vessel size and two age categories (see chart below), using price curves for 5 and 15 year old vessels as a reference for asset price trends. The chart shows that there appears to be a clear link between prices and activity, with strong liquidity for most of 2022 reflected in rising asset prices over the same period. Similarly, the slowdown in activity has led to a temporary stagnation in prices.

The only deviation was the strength of the Suezmax tankers in the second quarter of 2023, which led to an immediate spike in price levels, only to be followed by a rapid fall in prices as activity collapsed during the quarter. Looking at the current state of the market for buying and selling vessels in the recent past, after a downturn in the third quarter of 2023, volumes have risen steadily over the past few quarters and prices have once again shown a modest increase.

A legitimate question is whether a liquid market will herald the next price jump," says Allied. Tempting as it may sound, excess demand is rare in the higher price ranges. However, current market signals suggest fundamentals are robust enough to maintain strong levels of support with relatively little downside risk."

"Measuring the potential of the overage fleet appears to be a challenge at present. Three consecutive quarters of quarterly averages (excluding the jump in VLCCs during Q1 2024) may have signalled some form of ceiling (or state of maturity) for prices and buying interest. Beyond a brief period of recovery and speculative volatility, pressure will eventually emerge and may not be too far away. Conversely, a favourable view on the potential for fleet growth could protect seemingly 'inflated' prices in modern assets in the meantime." Allied concludes.

https://www.cnss.com.cn/html/sdbd/20240409/352811.html

|