The recent performance of the Very Large Crude Carrier (VLCC) market has been particularly notable in the global shipping landscape. Over the past few months, VLCC asset prices have been hovering near record highs.

Shipbroker Gibson said in its latest weekly report, "VLCC ship asset prices seem to be caught in a paradoxical market situation. On the one hand, traditional market sentiment and pricing models suggest that prices appear to be approaching overheated levels, echoing the 2008 peak; on the other hand, current supply dynamics appear to be temporarily justifying such price increases."

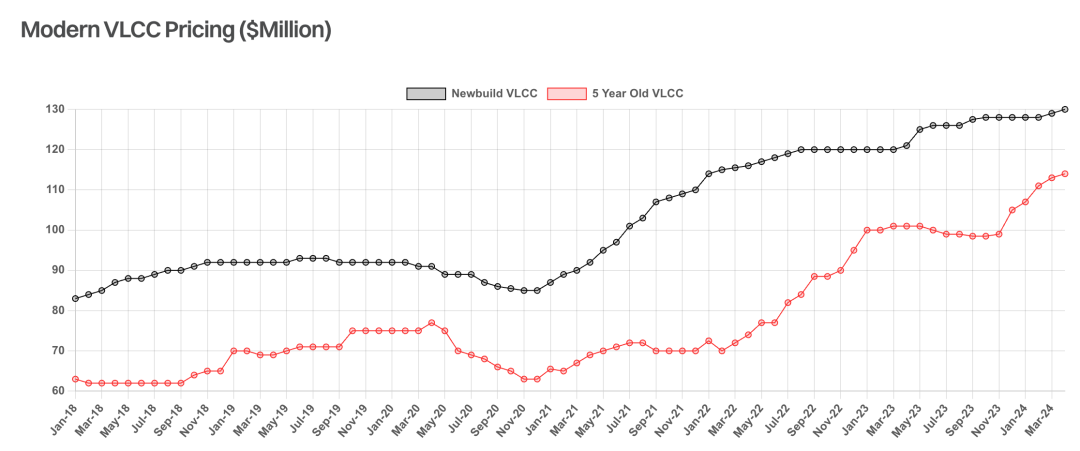

The report notes that one of the key indicators that the second-hand market may be overheating is the price differential between five-year-old benchmark vessels and current newbuilding benchmarks, which has narrowed to about 12 per cent, the smallest gap since 2015 when OPEC's competition for market share led to second-hand prices briefly outstripping those of newbuildings. As of April 2024, the newbuilding price of a modern VLCC will be around $130 million, while the price of a five-year-old modern VLCC will be around $114 million.

The surge in prices and demand for vessels can be attributed to the widespread belief that recent deliveries will generate higher returns in the short to medium term, a sentiment that is supported by fundamentals," Gibson said. In the short term, growing geopolitical uncertainty has led to a gradual rise in VLCC freight rates. In particular, the Red Sea attacks have stimulated the fragmentation of maritime trade in favour of long-haul shipments by larger vessels. More importantly, in recent years, a significant portion of the fleet, especially older vessels, has been transferred to the shadow fleet to transport sanctioned crude oil. Currently, we estimate that 19 per cent of the existing fleet is involved in this type of trade and has no access to mainstream international markets. In the longer term, the expected increase in US crude oil production and continued demand growth east of Suez also bodes well for structural growth in the long-haul crude oil trade."

"Despite the upturn in newbuilding orders this year, overall the proportion of the VLCC fleet on order remains relatively low at just under 7 per cent. While this figure has risen over the past three to four months from around 3 per cent in November last year, the majority of deliveries are scheduled beyond 2027, with only a few expected to be delivered in 2025 and 2026, which has supported the recent strength in second-hand vessel prices. In addition, the ageing of a significant portion of the fleet, with nearly a third of the vessels over 15 years old, may limit future tradability in many areas. As a result, the increase in order intake may be offset by the ageing fleet."

"In addition, an aspect that is often overlooked when assessing asset prices is the impact of inflation. Whilst prices may appear relatively high, at first glance they may not look that high. Adjusted for the US CPI, a VLCC newbuilding priced at US$160 million in 2008 would be equivalent to US$232 million today. While current prices have not reached that level in real monetary terms, neither have spot market returns, which averaged $113,000 per day in 2008, equivalent to about $164,000 today. Today's spot market returns are only around $50,000 to $60,000 per day, which may suggest a suspicion of overvaluation."

"However, the combination of geopolitical tensions, a relatively low order book and an ageing fleet suggests that freight rates are not likely to come under significant downward pressure over the next two to three years. When assessed in terms of forward earnings potential, newbuildings and second-hand vessels can be considered to be reasonably valued and are likely to remain at high levels for some time." Gibson concluded.

https://www.cnss.com.cn/html/hygc/20240514/353217.html

|