The seaborne coal market is experiencing significant volatility and adjustment, driven by the global economic recovery and changing political situation. The resumption of growth in Australian coal exports and the normalisation of relations with China have been key factors in this market shift.

In its latest weekly report, shipbroker Banchero Costa said, "The global coal trade has really picked up pace in recent months and has now fully recovered to pre-epidemic levels."

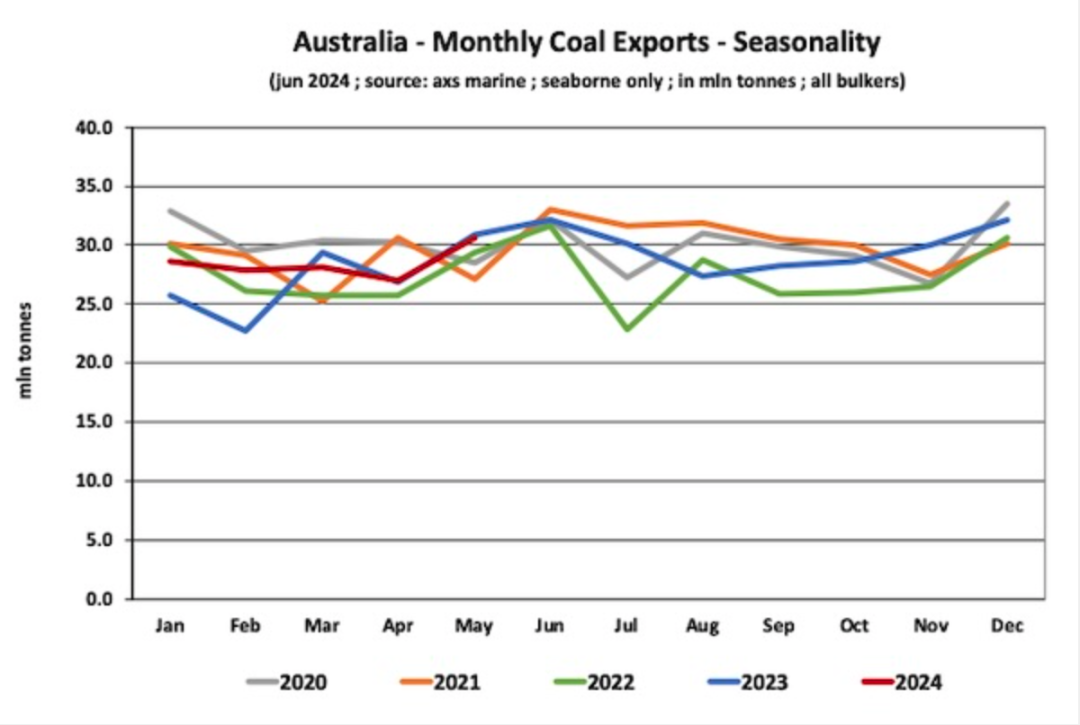

Global seaborne coal loadings (excluding cabotage) grew by 5.8% year-on-year to 1,339.5 million tonnes in 2023, a trend that continued in 2024, according to AXS Marine's vessel tracking data.Global seaborne coal loadings increased by 2.5% year-on-year to 556.8 million tonnes from January to May 2024, according to AXS Marine's vessel tracking data. This growth was largely driven by the strong performance of Indonesian and Australian coal exports.

Specifically, Indonesia's exports rose 8.2 per cent year-on-year to 215.5 million tonnes; Australia's exports rose 4.9 per cent year-on-year to 142.1 million tonnes; Russia's exports declined 16.2 per cent year-on-year to 67.2 million tonnes; the United States' exports rose 2.4 per cent year-on-year to 35.7 million tonnes; South Africa's exports declined 1.4 per cent year-on-year to 25.2 million tonnes; Colombia's exports increased 17.9 per cent year-on-year to 25.1 million tonnes; Canada's exports fell 5.4% year-on-year to 19.7 million tonnes; and Mozambique's exports fell 7.7% year-on-year to 8.6 million tonnes.

As one of the world's largest coal importers, changes in China's market demand have a significant impact on the global coal trade, Banchero Costa said. from January to May 2024, China's seaborne coal imports increased by 10.1% year-on-year to 160.5 million tonnes; India's seaborne coal imports increased by 11.0% year-on-year to 105.7 million tonnes; and Japan's and South Korea's coal imports declined, while EU coal imports fell by 43.6% to only 25.3 million tonnes.

Australia is the world's second-largest coal exporter, and fluctuations in its exports have a significant impact on the global market. in 2023, Australia accounted for 25.7 per cent of global seaborne coal exports, well behind Indonesia, which had a 36.9 per cent market share. In recent years, Australian coal exports have been heavily influenced by political factors.

As a result of political tensions between China and Australia, China imposed an 'unofficial ban' on Australian coal at the end of 2020, which led to a significant drop in Australian coal exports that year, down 7.1 per cent year-on-year.

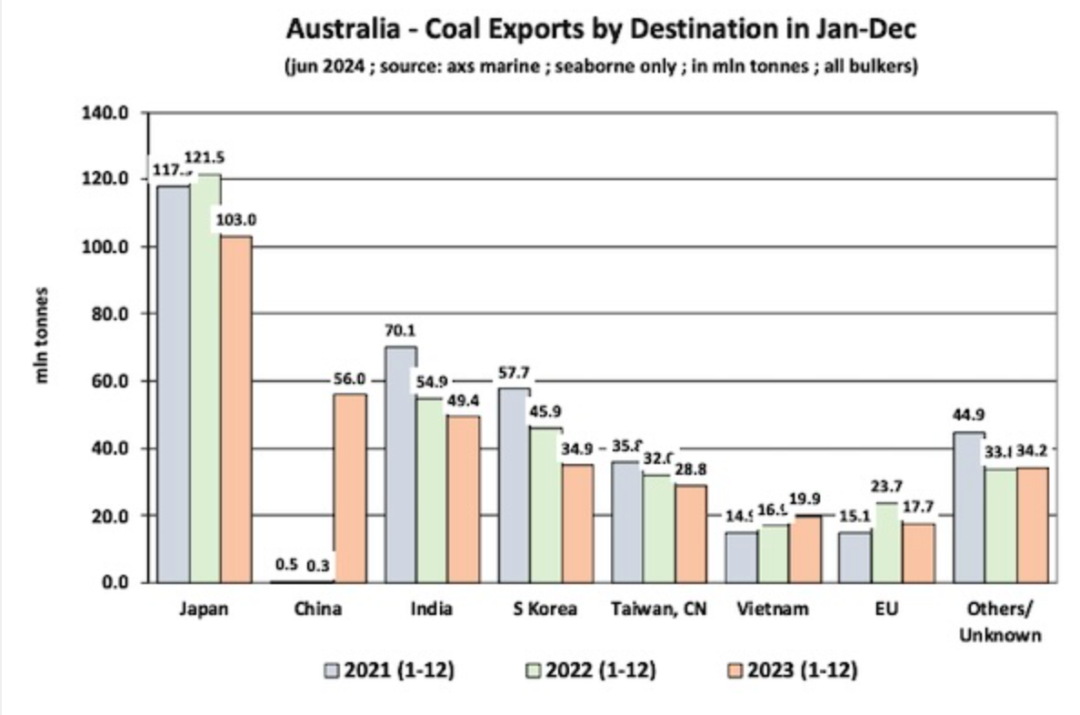

During the ban, Australia was forced to turn to other buyers, such as India, to absorb its coal exports. The ban was lifted in February last year as relations between China and Australia were repaired, and Australian coal exports to China have been recovering ever since, with Australian coal exports to China rebounding rapidly in 2023, surging to 56 million tonnes from 500,000 tonnes in 2022, and Australia's full-year coal exports resuming growth to 344.1 million tonnes.

In 2023, 56 per cent of coal shipped from Australia is loaded on Panamax or super-Panamax vessels, 40 per cent on Cape of Good Hope vessels, and 4 per cent on handysize or super-handysize vessels.

Banchero Costa added: "The situation in India is quite the opposite. in 2021, Australia exported 70.1 million tonnes of coal to India, up 35.8 per cent year-on-year from 51.6 million tonnes in 2020. However, in 2022, Australia's coal shipments to India declined by 21.6 per cent year-on-year to 54.9 million tonnes due to increased coal supply from Indonesia. in January-December 2023, Australia exported 49.4 million tonnes of coal to India, a 10.0 per cent year-on-year decline. However, the largest destination for Australian coal remains Japan, with exports of 103 million tonnes in 2023, down 15.3% year-on-year, but still accounting for 29.9% of Australian coal exports. China now accounts for 16.3 per cent of Australia's coal exports, India 14.4 per cent, South Korea 10.1 per cent, Taiwan 8.4 per cent, Vietnam 5.8 per cent and the EU 5.1 per cent."

https://www.cnss.com.cn/html/sdbd/20240709/354016.html

|