|

|

|

|

|

|

|

International Cooperation Department

Tel.: (+86-21) 65853850-8034

Fax: (+86-21) 65373125

E-mail: ICDept@sisi-smu.org

|

|

|

|

|

International Shipping |

|

| The number of newbuild bulk carriers fell sharply! |

|

Date:2024-07-22 Readers:

|

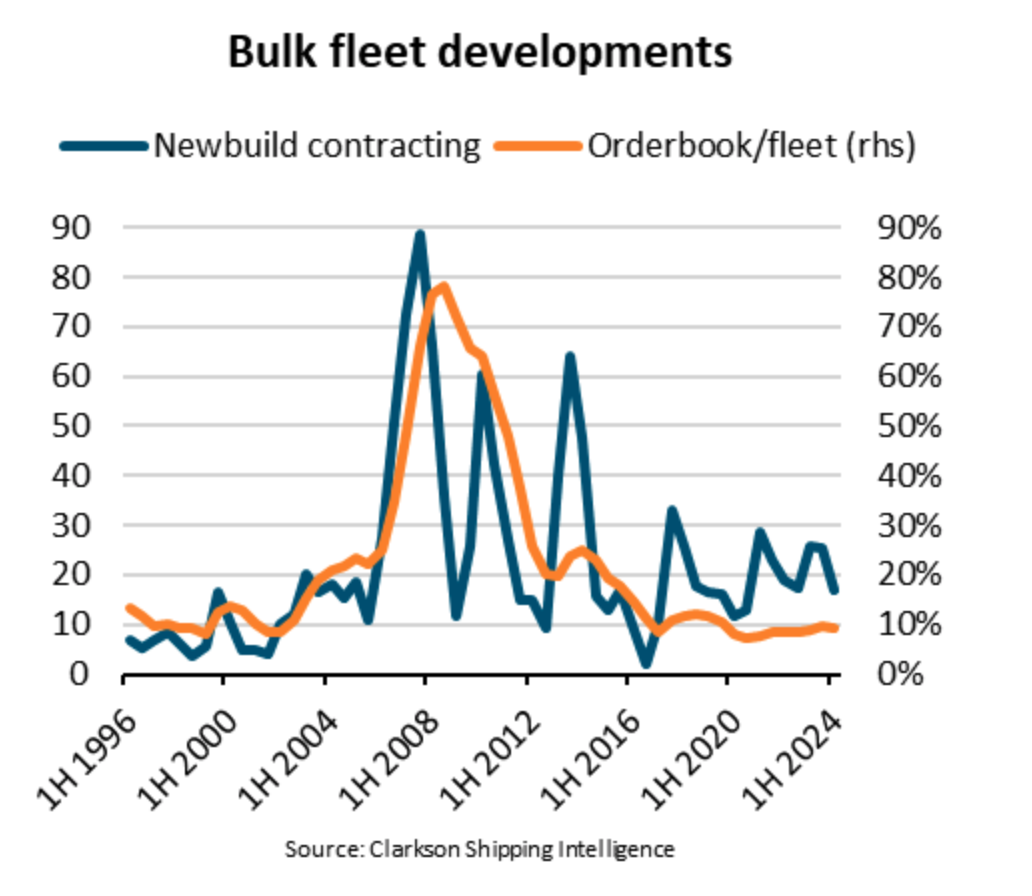

Despite a booming market in the first half of 2024, with strong trading of second-hand dry bulk carriers, the number of newbuildings fell sharply year-on-year.

According to the latest report from the Baltic International Maritime Council (BIMCO), orders for new dry bulk carriers fell by 34.2 per cent year-on-year in the first half of the year, and newbuilding prices rose by 6.5 per cent year-on-year, which may have contributed to the decline in contract volumes. However, the situation in the second-hand ship market was different, with volumes increasing by 11.7 per cent despite a 15.2 per cent year-on-year rise in prices.

According to BIMCO analyst Filipe Gouveia, other factors such as limited yard availability and uncertainty over the outlook for fuel and demand may also have contributed to the hesitancy of shipowners to place orders for new vessels.

"At the moment, shipyards remain busy with ship orders in other sectors. Order books for container ships and liquefied natural gas (LNG) vessels are considerable, and tanker orders have also increased since 2023. As a result, current ship contracts may not be delivered until after 2026, especially for larger vessels. By then, the current strong market conditions may have waned."

"Uncertainty in deciding which fuel should be used for newbuildings may also be holding back contracts. Shipowners are concerned about whether alternative fuels will be widely available in most ports and regions in the near to medium term."

"Finally, shipowners may be concerned about the demand outlook for certain commodities. Coal shipments are likely to peak this decade, while advances in the use of scrap to make green steel could impact iron ore shipments in the longer term." Filipe Gouveia added.

Despite the low volume of newbuilding contracts, the risk to the dry bulk fleet is not yet apparent.BIMCO data shows that the current average age of bulk carriers is 12.3 years, lower than that of tankers and containerships, and only 8.9 per cent of dry bulk capacity is over 20 years old. The current order book represents 9.4 per cent of the total fleet capacity, which should be sufficient to replace the capacity of recycled vessels in the short term.

Ultra Handysize and Panamax vessels are over-represented in the current order book at 34.5 per cent and 32.6 per cent respectively. Since the second half of 2023, orders for Panamax vessels have decreased, while orders for capesize vessels have increased slightly. Currently 14.2 per cent of handysize capacity is more than 20 years old, but handysize vessels account for only 3.8 per cent of the order book, and these vessels are likely to be replaced by ultra-handysize vessels when they are scrapped.

In the medium to long term, newbuilding orders are expected to recover as climate regulations become more stringent, BIMCO said. At the same time, fleet renewal will become inevitable, as it will become increasingly difficult for older vessels to comply with regulations. In addition, as the use of alternative fuels increases, the path to decarbonisation will become clearer, thus reducing uncertainty.

https://www.cnss.com.cn/html/sdbd/20240722/354145.html

|

|

Back:

Delhi plans to provide shore power to vessels large and small nationwide

Back:

Delhi plans to provide shore power to vessels large and small nationwide

Next:

US$500 million! Offshore giant wins another contract

Next:

US$500 million! Offshore giant wins another contract

|

|

|

|

|

|

|