|

|

|

|

|

|

|

International Cooperation Department

Tel.: (+86-21) 65853850-8034

Fax: (+86-21) 65373125

E-mail: ICDept@sisi-smu.org

|

|

|

|

|

International Shipping |

|

| Tanker market: volatility fuelled by the onset of hurricane season! |

|

Date:2024-07-23 Readers:

|

Every year, hurricane season is a time of heightened freight rate volatility in the shipping market, particularly in the tanker market, and this year is no exception.

According to the latest weekly report from Gibson Shipbrokers, Hurricane Beryl recently struck the Caribbean and the United States, becoming the earliest Category 5 hurricane in history and attracting widespread global attention. Many clients have enquired about the impact of the hurricane on the tanker market. The U.S. National Oceanic and Atmospheric Administration (NOAA) is forecasting a record number of tropical storms and hurricanes this year, with a rapid transition to La Niña conditions expected following the recent El Niño. The agency expects 17 to 25 named storms this year (an average of 15 since 1991), 8 to 13 hurricanes (an average of 7 between 1991 and 2023), and 4 to 7 major hurricanes (a historical average of 3). An active hurricane season means broader risks to crude oil and refined products markets, but the exact impacts are difficult to predict.

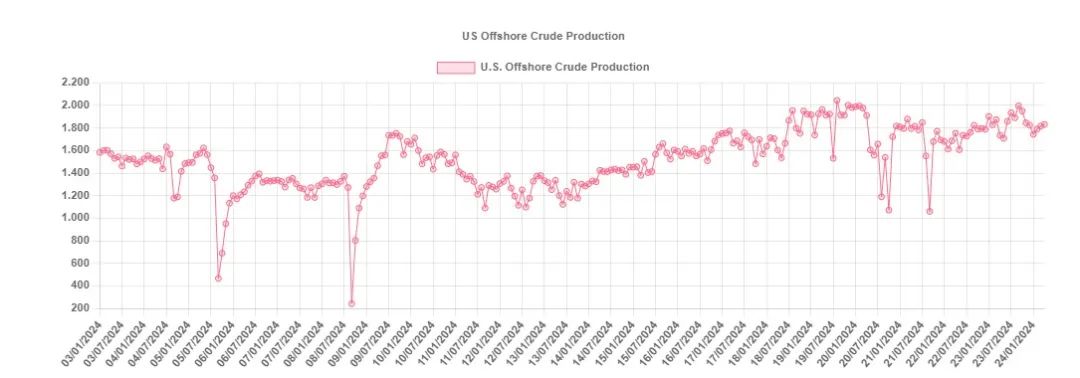

Gibson said there are two key factors to keep an eye on: the path and intensity of the hurricanes. While a Category 5 hurricane can be devastating to everything in its path, if oil and gas infrastructure is not affected, the impact is usually limited, except for potential delays due to vessels avoiding the hurricane's path. However, if a hurricane strikes an offshore oil and gas production facility, resulting in a prolonged shutdown, the main impact will be felt in the demand for crude oil exports from the United States and the Caribbean. The US and Mexico have a combined offshore crude oil production of 3.5 million b/d, most of which is the popular medium-heavy crude. In extreme cases, hurricanes could even drive imports of seaborne crude from further afield if there is a prolonged disruption to local supplies.

Another key impact is on refineries. Refineries along the Texas and Louisiana coasts account for 48 per cent of total US refining capacity. These facilities are critical to meeting U.S. domestic market demand and exported 2.1 million barrels per day (bpd) of refined products in 2023. Any disruption to refining operations would have a negative impact on the U.S. refined product tanker market in the Gulf of Mexico, with reduced exports. However, a shutdown of a major U.S. refinery could also have a positive impact on product tanker freight rates. In particular, the US Atlantic Coast relies on refined products delivered via pipeline from the Gulf of Mexico, and if Colonial pipeline flows were to dry up, these demands would typically be filled by European cargoes, thus supporting MR tanker freight rates on the UK to US Atlantic Coast (TC2) route. Refinery closures in the US Gulf of Mexico may also favour local crude exports. If U.S. refineries are unable to use domestic and regional crudes, then more crude oil may be available for export. Other factors, such as exemptions from the Jones Act may also have a positive impact on the international tanker market in the short term.

Gibson concluded that since no two hurricanes are the same, it is difficult to predict their impact specifically, other than increased freight rate volatility. Notably, U.S. refineries have become more efficient in responding to storm damage.When Hurricanes Katrina and Rita hit in 2005, it took Gulf Coast refineries about three months to return to pre-storm levels. In contrast, after Hurricanes Harvey and Irma in 2017, it took just 29 days. However, if the predicted active hurricane season becomes a reality, with frequent high-intensity storms following one another, the ability of refineries and crude oil producers to maintain production could be challenged.

https://www.cnss.com.cn/html/hygc/20240723/354166.html

|

|

Back:

"Becoming the world's top five", India to learn from China's experience

Back:

"Becoming the world's top five", India to learn from China's experience

Next:

Unprecedented! MSC capacity officially exceeds 6 million TEU!

Next:

Unprecedented! MSC capacity officially exceeds 6 million TEU!

|

|

|

|

|

|

|