With the addition of two second-hand vessels, the world's largest liner company once again ushered in an "unprecedented" milestone: the controlled capacity officially exceeded 6 million TEU.

Alphaliner's latest data shows that as of July 22, MSC's capacity has reached 6.012 million TEU. Specifically, MSC currently controls a total of 844 vessels, of which 546 are owned, with a capacity of 3.041 million TEU; 298 are leased, with a leased capacity of 2.970 million TEU; at the same time, MSC is holding 100 new vessels under construction, which is expected to add nearly 1.206 million TEU of capacity. add nearly 1.206 million TEU of capacity, and by 2025 the company's total capacity will exceed 7 million TEU.

Linerlytica notes that the addition of two second-hand vessels has helped MSC reach new milestones. in mid-July 2024, MSC purchased the vessels Ever Unity (53,364 TEU) and AS Clarita (2867 TEU). "In mid-July 2024, MSC purchased the Ever Unity (53,364 TEUs) and the AS Clarita (2,867 TEUs), the latter of which will join the fleet after completing its current dry-dock overhaul.

The acquisition of these two vessels epitomises MSC's high level of activity in the second-hand market over the past three years. Since 2021, MSC has been "unrivalled" in the industry through its capacity expansion spree, purchasing more than 300 second-hand containers with a capacity of more than 1 million TEUs, valued at $10 billion.

Bud Darr, MSC's executive vice president for maritime policy and government affairs, said at Marine Money Week in Manhattan last month that massive investment in capacity and building a larger fleet was one of the secrets of MSC's success.

MSC's founder, Captain Gianluigi Aponte, was a "loyal" shipowner whose family had a long history of reinvesting earnings into the business, a pattern that accelerated during the epidemic era.

Captain Gianluigi Aponte founded MSC in 1970 in Naples, Italy, and initially operated the Mediterranean-Somalia route with just two vessels. By the end of the 1980s, MSC had begun to expand, expanding into North America and Australia, and moving its headquarters to Geneva. in January 2007, MSC's capacity reached one million TEU for the first time, and a decade later it surpassed three million TEU, reaching four million TEU in July 2021, overtaking Maersk in January 2022, and officially surpassing five million TEU in May of last year.

Along with the significant capacity expansion, MSC's fleet strategy has also changed, shifting from the high-priced and hard-to-find charter market to second-hand purchases and newbuildings.

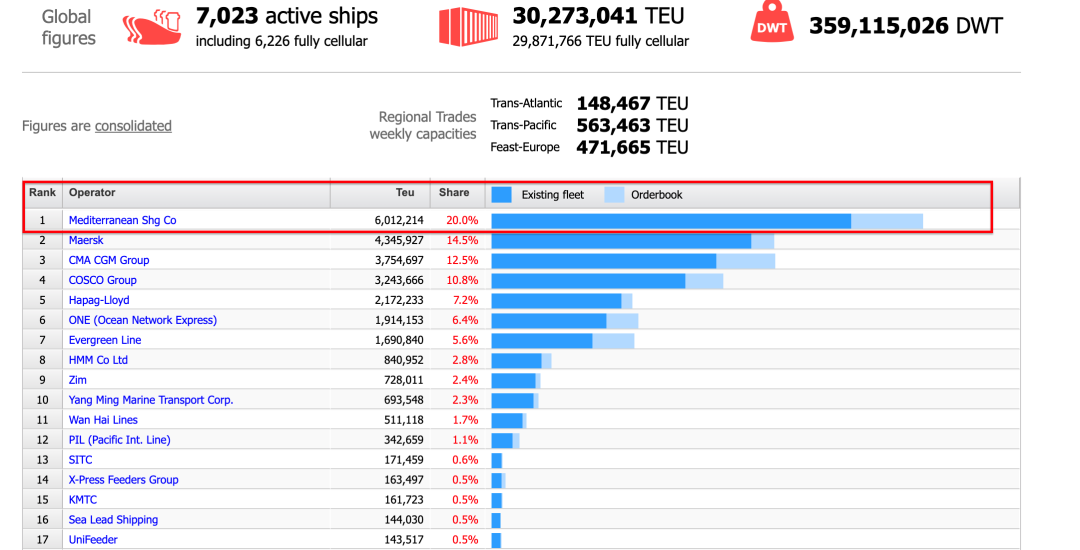

MSC currently owns half of its total capacity, a stark contrast to the company's strategy two and a half years ago. At that time, the company relied on chartered vessels for two-thirds of its capacity and had a market share of about 17 per cent, a figure that has now increased to 20 per cent.

MSC has made a significant breakthrough in capacity by increasing the proportion of owned vessels and reducing its reliance on the charter market. In the container transport market, a stable fleet of owned vessels means better control of capacity and costs, and improved market competitiveness.

MSC's 6 million TEUs, the first time in the history of the liner shipping company's fleet to reach this size, is part of the overall growth of the market, Alphaliner noted. Over the past year, the container shipping market has injected a huge 2.85 million TEU of incremental capacity, a growth rate of 10.6 per cent. Currently, the global market totals more than 7,000 vessels with a total capacity of more than 30 million TEU. up to 2024, Alphaliner reports an incremental capacity of 1.7 million TEU.

The second-hand vessel market continued to remain hot in the first half of 2024, with Alphaliner data showing that 141 vessels with 572,600 TEU of capacity changed hands in the global container fleet, a rebound from the market slowdown in the second half of 2023. An average of 23 vessels per month completed deals, partly due to capacity gaps caused by long voyages around Africa.

High demand and capacity shortages mean that almost every available vessel is in service and the shipbreaking market remains at a low point.Alphaliner notes that only 48,600 TEU (34 vessels) have been sold for dismantling so far in 2024.For the full year of 2023, the dismantling capacity stood at 158,000 TEU.

Maersk emphasised this week that the disruption caused by Houthi attacks in the Red Sea region has spread across the industry. This is expected to continue until 2025, meaning demand for container ships will remain high.

MSC has consistently kept a low profile in terms of its strategy and new orders. However, the industry widely expects MSC to continue to widen the gap with others even as carriers like Duffy Group (CMA CGM) have also adopted an aggressive newbuilding strategy.

https://www.cnss.com.cn/html/hyqy/20240723/354164.html

|