|

|

|

|

|

|

|

International Cooperation Department

Tel.: (+86-21) 65853850-8034

Fax: (+86-21) 65373125

E-mail: ICDept@sisi-smu.org

|

|

|

|

|

International Shipping |

|

| Orders are being added at a rate that is ‘way ahead of the curve’! This boat is so hot! |

|

Date:2024-08-26 Readers:

|

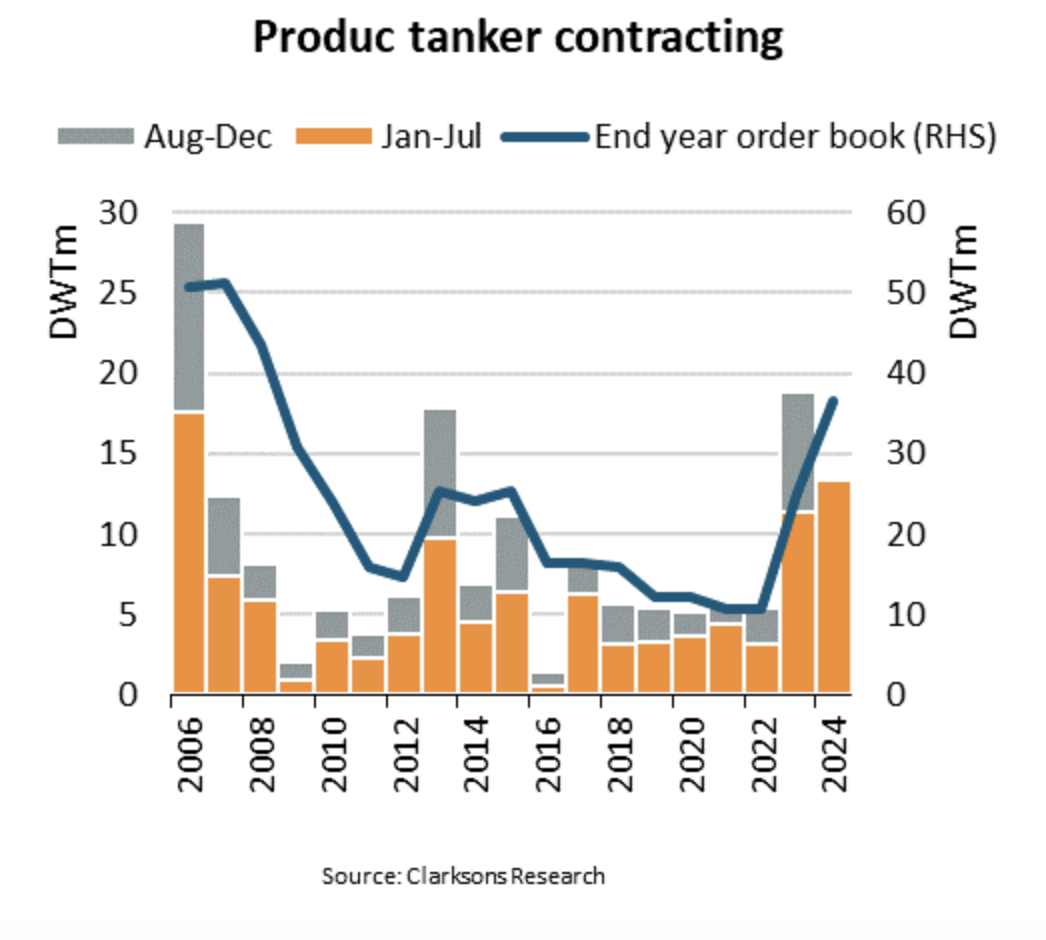

Since the beginning of 2024, the product tanker market has once again witnessed a boom in newbuilding. According to the latest data from the Baltic International Maritime Council (BIMCO), in the first seven months of this year alone, shipowners around the world have placed 194 new orders for product tankers with more than 10,000 deadweight tonnes (dwt), with a combined capacity of 13.3 million dwt. This figure represents a 17 per cent increase on last year and the highest level since 2006.

BIMCO said that new orders for product tankers in the first seven months of 2024 reached the second highest level on record, compared to the third highest level on record last year, ‘Throughout 2023 and 2024, new orders for product tankers have shown explosive growth, with the size of the order book soaring 135 per cent in 2023, and another 45 per cent year-to-date, reaching 37.1 million dwt. Of this, Chinese shipyards have been the biggest winners, accounting for 72 per cent of the global product tanker order book.’

This surge has resulted in the ratio of the order book to the existing fleet rising from 5.9 per cent at the start of 2023 to 13.6 per cent at the start of 2024, and climbing to 19.6 per cent today, according to the data. Ninety per cent of the order book is expected to be delivered between 2025 and 2027, suggesting that there is significant potential for the size of the fleet to grow over this period.

In fact, since the beginning of last year, the order book for product tankers has grown at the leading rate of all cargo ship types, at 241 per cent. By contrast, the order book for crude oil tankers has grown by 151 per cent.

Despite the strong demand for newbuildings, the average age of the existing product tanker fleet is also rising year on year. Currently, the average age of product tankers has gradually increased by almost five years from its low point in 2011 to 13.6 years. It is worth noting that vessels currently older than 20 years account for 13 per cent of the total fleet, compared to 10 per cent of their deadweight. The scrapping of older vessels may be able to alleviate the pressure on fleet growth due to new vessel deliveries to a certain extent.

However, the current strong performance of the product tanker market does not suggest a rapid increase in scrapping. Even if scrapping volumes over the next three years reach a record high of 3.8 million dwt, a maximum of 12 million dwt will be recovered by the end of 2027. By contrast, the order book shows that 35.3 million dwt tonnes of new vessels will be delivered during this period, resulting in a net increase of 23.3 million tonnes in fleet size by the end of 2027, an increase of 12.5 per cent.

Niels Rasmussen, principal analyst at BIMCO, noted that while demand for petrochemicals may continue to grow, demand for product tankers is particularly affected by the process of decarbonisation, notably the spread of electric vehicles. Supply of product tankers is likely to outstrip demand in the coming years if the volume of old vessels being scrapped and disposed of does not increase significantly.

Against this backdrop, shipping companies need to carefully assess the current market situation versus the sustainability of future demand growth. Blindly pursuing fleet expansion may lead to future operational risks, especially as the demand outlook for the product tanker market is fraught with uncertainties amidst the accelerating transformation of the global energy mix. How to reasonably control the fleet size and optimise capacity allocation before the peak of new vessel deliveries will become the key for shipping companies to maintain their advantages in the fierce market competition.

In addition, the increasingly stringent environmental regulations and the development of ship decarbonisation technology will also have a profound impact on the product tanker market. In the coming years, shipping companies may need to invest more in green technologies to cope with the increasingly stringent environmental standards. Only those companies that are able to respond flexibly to changes in the market and have a forward-looking strategic vision will be able to take advantage of the uncertainty ahead.

https://www.cnss.com.cn/html/hygc/20240823/354409.html

|

|

Back:

Voyage Optimization Plan Led to Grounding of Bulk Carrier

Back:

Voyage Optimization Plan Led to Grounding of Bulk Carrier

Next:

A leakage occurred during refuelling of a container ship in Hong Kong!

Next:

A leakage occurred during refuelling of a container ship in Hong Kong!

|

|

|

|

|

|

|