|

Shanghai International Shipping Institute published

the Chinese Shipping Prosperity Report in Q1 2016 on April 5, 2016. The report

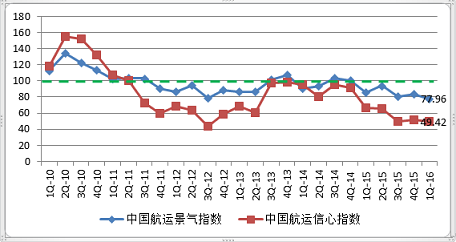

shows that the Chinese Shipping Prosperity Index (CSPI) stood at 77.96 points

in the stagnant interval in Q1 2016, a new low since the first publication of

Chinese shipping prosperity index in 2009. The Chinese Shipping Confidence

Index (CSFI) registered 49.42 points, remaining in the depression since Q3

2011. The overall business performance of ship owners, port enterprises and

shipping service enterprises kept deteriorating.

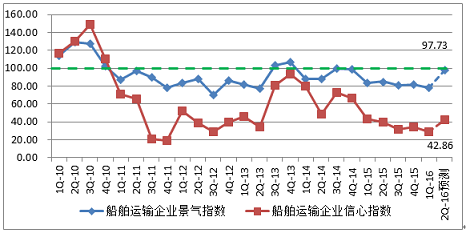

Fig.

1 Trends of Chinese Shipping Prosperity Index and Confidence Index

1 Profitability of Ship Owners Continues Deterioration But with Enhanced

Control over Shipping Capacity

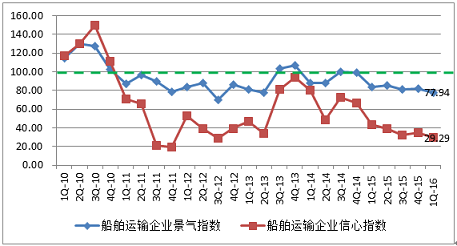

In Q1 2016, the prosperity index of shipping

transport enterprises stood at 77.94 points in the stagnant interval; the

confidence index of shipping transport enterprises stood at 29.29 points in the

moderately stagnant interval. Affected by the dramatically declining space utilization

and freights, the profitability of ship owners continued to deteriorate. Ship

owners strengthened control over the shipping capacity and their willingness in

shipping capacity investment hit a historic bottom. When the global seaborne

transportation market fails to see improvement in the short term, ship owners significantly

enhanced the control over the current funds.

Fig

2 Trends of Prosperity Index and Confidence Index of Shipping Transport

Enterprises

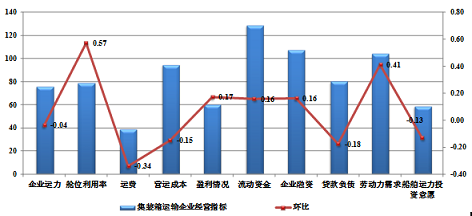

Capital chains of seaborne dry bulk transportation enterprises tightened. In Q1 2016, the prosperity index of dry bulk

transportation enterprises was 62.28 points in the stagnant interval, down 6.39

points from the previous quarter; the confidence index of dry bulk

transportation enterprises was 7.22 points, down 33.34 points from the previous

quarter and falling to the moderately stagnant interval. The vessel turnover of

dry bulk transportation enterprises dropped dramatically and the freights kept

hitting new lows, leading to sprawling losses of enterprises. The prosperity

index of profit/loss indicator of dry bulk transportation enterprises was only

25.33 points. As a result, nearly half of dry bulk transportation enterprises

suffer financial constraints and this proportion is 11.4 percentage points

higher than that in the previous quarter.

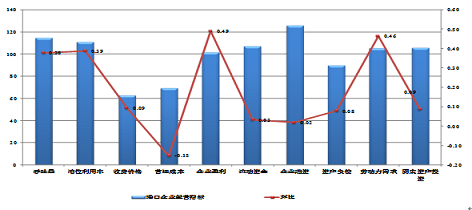

Fig.

3 Prosperity Index of Business Indicators of Dry Bulk Transportation

Enterprises

Profitability of container transportation enterprises deteriorates

dramatically. In Q1 2016, the current funds, enterprise financing

and labor demand indicators of container transportation enterprises all enjoyed

slight pickup and stayed in the prosperous interval. However, the prosperity

index of enterprise profitability only registered 59.95 points, mire in the stagnant

interval for four consecutive quarters. The profitability of container

transportation enterprises witnessed sharp deterioration. In addition, affected

by the increased loan liability, lowered freights and increased operating

costs, the enterprises are increasingly reluctant in shipping capacity

investment.

Fig. 4 Prosperity Index of Business Indicators of Container Transportation Enterprises

2 Inflection Point of China’s Port Industry in Sight

After the financial crisis, the seaborne transportation

market becomes dismal and bankruptcies of shipbuilding enterprises or shipping

enterprises frequented the headlines. Against the backdrop, however, China’s

port enterprises maintained a stable development trend. But with the continuous

slowdown of China’s economy growth, the business volume of port enterprises

kept gliding and the profitability performance of loading/unloading businesses

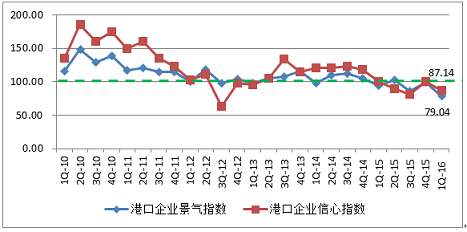

of port enterprises is nowhere near the past. In Q1 2016, the prosperity index

of Chinese port enterprises registered 79.04 points in the stagnant interval, a

historic low. Affected by the slowed-down growth of China’s economy, the port

throughput, berth utilization, port charges all witnessed sharp declines

against Q4 2015, with the profitability of port enterprises deteriorating

severely. In Q1 2016, the prosperity index of port enterprise profitability was

51.89 points, refreshing the historic low and staying in the stagnant interval.

Fig.

5 Trends of Prosperity Index and Confidence Index of Chinese Port Enterprises

3 Shipping Service Enterprises Stagnant for 4.5 Years in a Row

According to Chinese shipping prosperity survey,

the prosperity index of shipping service enterprises in Q1 2016 stood at 76.91

points, a rise of 13.41 points from the previous quarter but still in the

stagnant interval. In Q1 2016, the confidence index of shipping service enterprises

was 38.53 points, a slight pickup from the historic low in the previous

quarter, but still in the moderately stagnant interval. The market was haunted

by the pessimistic attitude. In terms of business indicators, apart from the current

funds which is relatively assuring, all the other indicators such as the

business volume, the business orders, profitability and labor demand were in

the stagnant interval, showing the deteriorating business performance of

enterprises.

Fig. 6 Trends of Prosperity Index and

Confidence Index of Chinese Shipping Service Enterprises

4 Forecast of Q2 2016

Q2 2016, it is forecast that the CSPI will reach 97.18 points, 19.22 points higher than the previous quarter to return to the slightly stagnant interval. The CSFI is forecast at 60.78 points in the stagnant interval. According to Chinese shipping prosperity survey, 55.2% of surveyed shipping enterprises hold a pessimistic view toward the overall performance of shipping industry in Q2.

Fig.

7 Forecast Trends of CSPI and CSFI

Deterioration of shipping transport enterprises

expected to ease. According to Chinese shipping prosperity survey,

the prosperity index of shipping transport enterprises in Q2 2016 is forecast

at 97.73 points, approaching the demarcation line. The confidence index of

shipping transport enterprises in Q2 2016 is forecast at 42.86 points, up 13.57

points compared with Q1 but still in the moderately stagnant interval,

reflecting enterprise owners’ lack of confidence in the industry. In terms of

the business indicators, persons in charge of ship owners generally hold a high

expectation of growth in the freights and vessel turnover in Q2, and the

profitability and current funds indicators will also improve. To be specific,

the prosperity index of container transportation enterprises is forecast at

105.4 points and may step into the prosperous interval again after one year of

depression. The prosperity index of dry bulk transportation enterprises is

forecast at 88.99 points, 26.71 points higher than the previous quarter and in

the relatively stagnant interval.

Fig.

8 Forecast Trends of Prosperity Index and Confidence Index of Shipping

Transport Enterprises

The prosperity index of port enterprises gaining on

the demarcation line. According to Chinese shipping prosperity survey,

the prosperity index of port enterprises in Q2 2016 is forecast at 99.27

points, an increase of 20.23 points from the previous quarter, gaining on the

demarcation line but still in the slightly stagnant interval. The confidence

index of port enterprises is forecast at 84.87 points in the stagnant interval.

The throughput, berth utilization and other business indicators of port

enterprises will all welcome significant growth, but as the port charges may

decline and operative costs may go up, the profitability of port enterprises

may have limited space for improvement in Q2.

Fig. 9

Forecast of Business Indicators of Port Enterprises in Q2 2016

Deterioration in business performance of shipping

service enterprises may slow down. According to Chinese shipping prosperity survey,

the prosperity index of shipping service enterprises in Q2 2016 is forecast at

94.34 points, an increase of 17.43 points from the previous quarter, but still

in the slightly stagnant interval. The confidence index of shipping service

enterprises in Q2 2016 is forecast at 60.57 points in the stagnant interval.

The business orders and profitability indicators of shipping service

enterprises will enjoy improvement.

Fig. 10 Forecast Trends of Prosperity Index and Confidence Index of

Shipping Service Enterprises

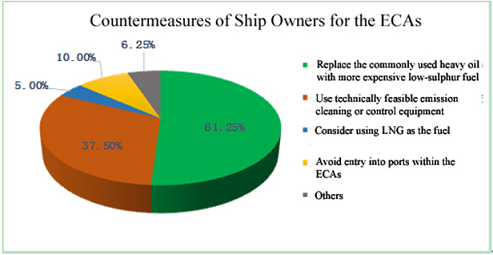

5 Ship Owners Plan

Multiple Measures for ECAs

The Yangtze River Delta will take the lead to implement emission reduction

since April 1, 2016. The Pearl River Delta and Bohai Rim Waters will keep up

soon. How will shipping enterprises cope with the Emission Control Area plan?

What new opportunities are there? Shanghai International Shipping Institute

conducted a survey on ship companies. The survey shows that more than 60% of surveyed

ship owners chose “Replace the commonly used heavy oil with more expensive

low-sulphur fuel”, 37.5% of surveyed ship owners chose "Use technically

feasible emission cleaning or control equipment", 5% of ship owners chose

"Consider to use LNG as the fuel" and 10% of the surveyed ship owners

chose "Avoid entry into ports within the ECAs".

Fig. 11 Ship Owners' Countermeasures to ECAs

Note: Questions in this survey allow multiple

choices.

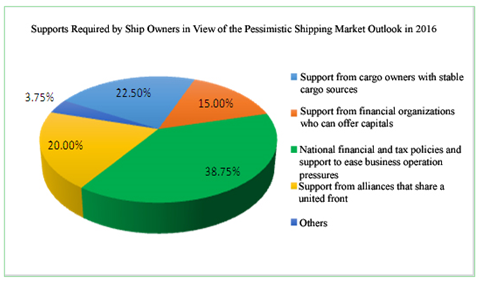

6 Seaborne Transportation Enterprises Call for Financial and Tax Policy

Support from Government

With the excessive seaborne shipping capacity worldwide and the low

freights for a long time, the business performance of enterprises is on the

slide and the seaborne transportation industry calls for government support.

The most requested support from enterprises is about the financial and tax

support from the government. Around 38.75% of ship owners chose "national

financial and tax policies and support to ease business operation

pressures" and around 20% of shipping owners chose "support from

alliances that share a united front". Some other enterprises chose

"support from cargo owners with stable cargo sources" or

"support from financial organizations who can offer capitals".

Fig. 12 Survey Results of Supports Required by Ship

Owners in View of the Pessimistic Shipping Market Outlook in 2016

|