Bank of America's latest report shows that since March this year, the deterioration of port congestion has led to a reduction of more than 2 per cent in the supply of container ships, Singapore, Dubai and the Mediterranean Sea is the focus of congestion in the region, while the Asian region's container supply is still very tight.

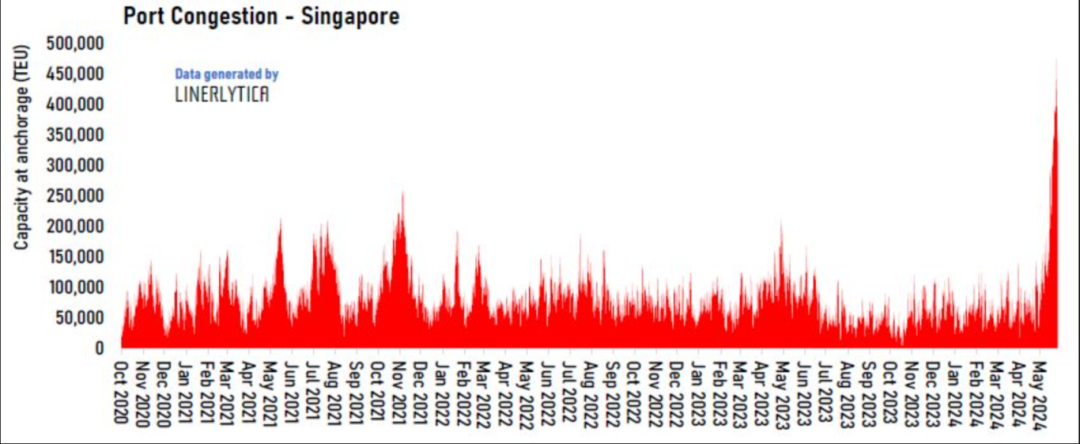

Container consulting firm Linerlytica also said in its latest report: ‘port congestion again disrupted the container market, Singapore has become the latest blocking point, its container congestion reached an unprecedented level of criticality’, the report pointed out that: at present, a large number of ships outside the port of Singapore queuing up to wait for berthing, the backlog of containers exceeds the alarming number of containers. The backlog of containers exceeds a staggering 450,000 TEUs. According to estimates, these ships will face up to seven days of waiting time.

‘The severe congestion has forced some liner shipping companies to cancel their planned calls at the Port of Singapore, which will put pressure on downstream ports, which will have to handle the additional container volume,’ Linerlytica noted.

Shanghai and Qingdao are also experiencing large queues of container ships waiting to berth. As the world's largest container port, waiting times for ships at Shanghai have now reached their highest level in three years.

Judah Levine, head of research at Freightos, a container booking platform, commented: ‘Shipping delays and flight cancellations are one of the reasons for the shortage of empty containers and vessel congestion in some Chinese ports, as well as congestion problems in Singapore and Malaysia.’ Port Klang, Malaysia, was ranked eighth in Linerlytica's list of today's most congested container ports.

Sea-Intelligence analysts in its latest weekly report pointed out that: ‘Asian port congestion and a sudden surge in demand, absorbing a large amount of capacity, and the current market capacity has been insufficient.’ And added: ‘Asian port congestion and a sudden surge in demand, absorbing a large amount of capacity, and the current market capacity has been insufficient.’ And added: ‘carriers to cancel flights, in fact, not to limit capacity, but simply because when the ship into the congestion, they do not have free ships to maintain the weekly service.’

In addition, HSBC said in a report to clients, ‘Port congestion has led to inefficient cargo movement, and in order to ensure on-time flights, some carriers have chosen to jump ports, further squeezing already tight capacity.’

Since November last year, the conflict in the Red Sea region has had a profound impact on the global shipping industry. Vessel sailing plans have been forced to change, which not only affects the major ports in Asia and Europe, but also to the global supply chain has brought unprecedented pressure. As the conflict continues, the shipping industry is expected to face further challenges and uncertainty in the future.

https://www.cnss.com.cn/html/gkdt/20240529/353495.html

|