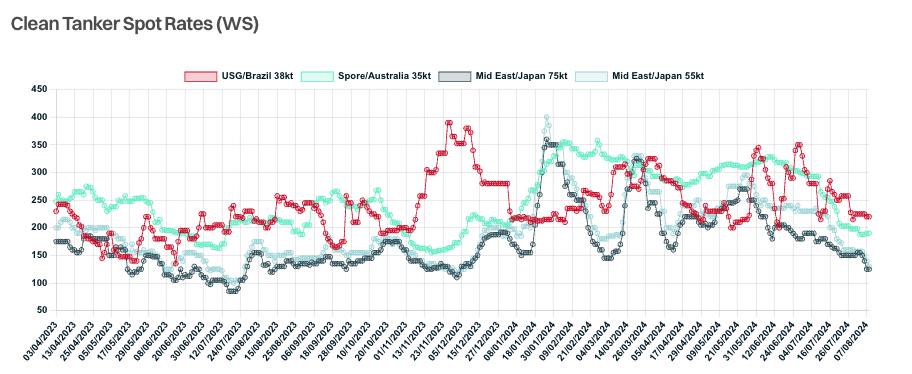

The market for product tankers is coming under significant pressure in the short term as more crude oil tankers wash their tanks to transport refined oil products, warns Danish ship operator Norden.

Typically, product tankers can transport crude oil products, crude oil tankers such as VLCCs, which primarily transport crude oil, can transport certain refined oil products after tank washing in special cases, and some tankers are specifically designed to have coated tanks, which allow them to switch between crude oil and refined products such as gasoline and diesel. Even uncoated crude oil tankers can carry refined oil products on their maiden voyage when brand new from the factory. However, due to the high cost of clearing tanks plus the effect of different cargoes on the coating of the ship's bulkheads, crude oil tankers are less likely to carry refined oil products.

However, since last month, everything from small crude oil tankers to VLCCs have been washing tanks to transport diesel from the Middle East to Northwest Europe. Market participants are looking to utilize crude tankers to reduce unit freight costs. This shift has weakened demand for product tankers, leading to lower freight volumes and weaker freight rates.

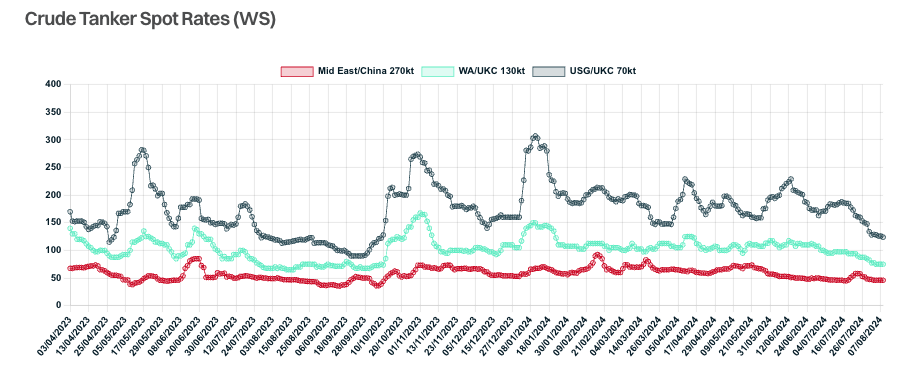

Freight rates for LR2 tankers transporting 75,000 tons of refined products from the Persian Gulf to the U.K. mainland fell to $53.47 per ton on Aug. 8, compared with $74.20 on July 1, according to Platts data. On the crude oil tanker side, while Arabian Gulf to China VLCC freight rates briefly climbed to $13.34/mt on July 24, they fell from $10.95 on July 1 to $10.11 on August 8 due to weak seasonal demand.

Shipbroker Gibson said in its latest report that with global tanker market earnings recently falling to their lowest level of the year, coupled with stock market turmoil, an accelerating energy transition and heightened geopolitical risks, many can't help but begin to question: is this a simple seasonal slowdown, or does it represent a deeper, systemic problem?

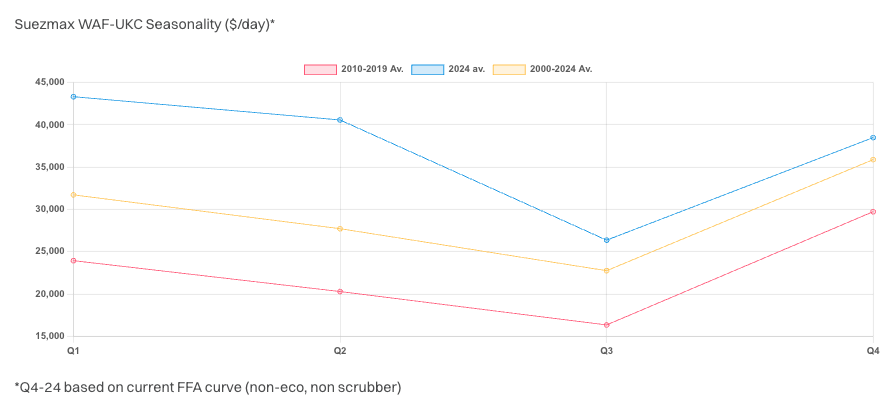

“In the crude oil market, the third quarter is typically the period of weakest returns. This year's performance has been broadly in line with this trend, with drivers such as weather factors reducing market volatility. In addition, OPEC+ production cuts and weak Chinese demand have weighed on the market, exacerbated by a slowdown in U.S. crude oil exports, which are now essentially unchanged from the same period last year.”

Despite the lengthening of routes due to the Red Sea crisis, crude oil ton-nautical mileage has remained weak this year. ton-nautical mileage of VLCCs and Suezmax tankers has only increased by 1%, while ton-nautical mileage of Aframax tankers has even declined by 1%. Compared to the crude oil market, the situation in the refined oil products market is more complex and the seasonal impact is more regional. While tonne nautical miles of refined oil products have had a strong year, with tonne miles of LR2 tankers up 24% year-on-year and tonne miles of LR1 and MR tankers up 4% and 5% respectively, this growth has been concentrated in the early part of the year, with tonne nautical miles trending downwards in recent months.

In its quarterly report, Norden noted that short-term headwinds from weak crude oil prices have led to a shift in large tankers from crude oil to refined products transportation.

Gibson similarly confirmed that this was partly due to competition from crude tankers shifting to the refined products market. Data showed that between June and July, 25%-28% of refined product shipments from the Middle East/West India to Europe were made by VLCCs and Suezmax tankers.

The shipbroker said, crude oil market last year, the third quarter market had a strong rebound from the trough to the highs of the fourth quarter, we expect this trend will be repeated this year. Crude oil exports are expected to increase as the U.S. carries out maintenance in the fourth quarter, while Asian refineries will also start purchasing crude oil after the shutdown. While China's aggregate demand levels remain a concern, the outlook for the sector remains healthy even in the face of slowing growth, suggesting that the current weakness is largely driven by seasonal trends.

“In terms of the refined products market, in the Middle East, the third quarter is usually the strongest as Middle Eastern refineries ramp up production significantly during this period. However, this year the market has performed contrary to expectations despite transportation volumes remaining strong. Recent weakness in Far East exports has also been a factor, but market reports suggest that Chinese exports may rebound later in the year when larger export quotas may be issued. Looking ahead, the market will continue to be volatile but could face headwinds later in the fourth quarter before seasonal maintenance ends. In addition, it is less likely that VLCCs and Suezmaxes will enter the product tanker market in the fourth quarter, traditionally the peak season, but this could be an influencing factor in 2025 as new vessel deliveries accelerate.”

“Despite the changing market fundamentals, with slower oil demand growth and heightened macroeconomic and geopolitical risks, the outlook for the shipping market remains robust, thanks to structural changes in tanker flows and a rapidly increasing number of aging tankers, which is somewhat limiting the supply capacity of mainstream players. Overall, the current market weakness is largely attributable to seasonal factors and all markets are expected to improve over time.” Gibson added.

Norden also said that with historically relatively small order books and expected increases in OPEC exports, crude wheel fundamentals will remain supportive and the negative impact is expected to fade.

https://www.cnss.com.cn/html/hygc/20240813/354321.html

|